Protean Energy on track to upgrade vanadium Resource

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Protean Energy Limited (ASX:POW) is working towards delineating what could be a world-class vanadium deposit at the Daejon Project in South Korea.

In an encouraging sign, the company today announced that Stage 1 pXRF testwork at the project is 70% complete; technical work targeting a resource over 8.3 kilometre strike is on target for completion during the second quarter; and that updated geological modelling of vanadium ore zone is nearing completion.

POW is developing the multi‐mineral project through its 50% holding in Stonehenge Korea Limited (SHK). SHK owns 100% of the rights to three projects in South Korea, including the flagship Daejon Project that contains a vanadium Resource of 17.3Mlbs (largely indicated) grading 3186ppm V2O5 at a cut‐off of 2000ppm V2O5.

The Daejon Project was initially seen as a potential source of uranium for Korea’s nuclear power sector. However, it was determined that the project’s economic success would be enhanced by maximising the amount of vanadium recovered from mined ore. Strong vanadium prices (alongside a depressed uranium price) have supported this revised strategy.

Vanadium has historically been used in constructing high quality steel, but now is seeing increasing demand due to its use in energy storage. Vanadium Redox Flow Batteries, which deliver large scale energy storage solutions, are seeing demand growth of 33% per year, with estimates that they could account for 15-25% of the global energy storage market.

Of course, as with all minerals exploration, success is not guaranteed. Consider your own personal circumstances before investing, and seek professional financial advice.

POW is currently undertaking non-destructive testing of mineralised sections of 36,000m of historical core stored at the Korean Institute of Geoscience and Minerals (KIGAM). To date it has completed 9377 pXRF readings of the total 28,000 planned.

The KIGAM core analysis work programme consists of data collection from the historical core in two stages:

Stage 1 involves testing 42 high priority holes totalling 2344m of mineralised core. So far, 1620m of mineralised core has been analysed with 70% of the programme complete.

Once Stage 1 is complete POW can commence an interim Resource estimation of vanadium and uranium mineralisation over a segment of the Chubu prospect. This should be completed by the during the second quarter of this year with an interim Resource estimate expected six weeks on from completion of the test work.

Stage 2 will involve testing of 35 holes totalling 2315m of mineralised core, with the analysis of these intercepts to commence in mid-April 2018.

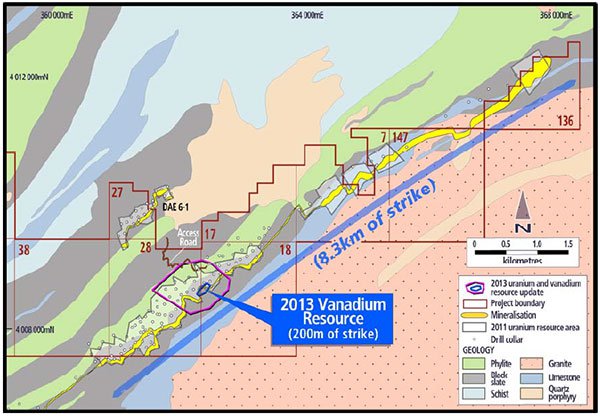

Completion of Stage 2 will enable POW to calculate an updated JORC-Code Compliant (2012) vanadium and uranium Resource over the entire 8300m of estimated mineralisation strike length. This strike can be seen on the map of the Daejon Project below:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.