Prospect identifies further high grades at Arcadia lithium project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Perth-based mining group, Prospect Resources (ASX:PSC), a company with three projects located in Zimbabwe has delineated high-grade lithium dioxide at its Arcadia project located near Harare in that country.

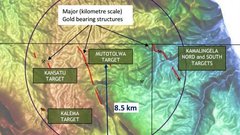

As a backdrop, the initial exploration target is up to 18 million tonnes at between 3% and 5% lithium dioxide. Its location in one of three well-known Zimbabwean lithium camps suggests its tenements are highly prospective and the fact that all drill holes in a maiden 48 hold drill program intercepted lithium bearing pegmatites augurs well for the future.

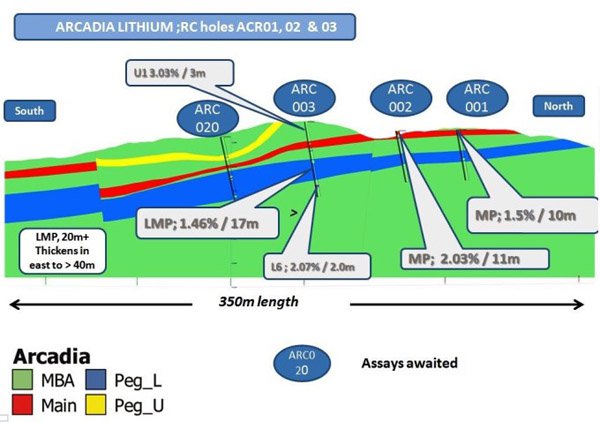

Today’s news that assay results from the first three drill holes returned a peak grade of 4.37% is positive from a number of perspectives. Firstly, all three holes identified the presence of lithium dioxide.

Furthermore, holes ACR003 and ACR002 returned grades of between 1.5% and 3% across relatively broad widths.

Management highlighted that the drilling to date had only covered approximately 10% of the exploration area. PSC’s ground position now covers more than 600 ha of mining licenses.

It is also worth noting that the drilled strike of the 14 stacked pegmatites now extends more than one kilometre south-west to north-east and approximately 350 metres down dip to the north-west.

There are some potentially positive share price catalysts on the horizon with management targeting the first JORC reportable mineral resource to be generated before the end of October.

A factor to bear in mind with regard to PSC, however, is the sovereign risk associated with countries operating in African regions which can experience political instability and other events outside of management’s control. You should seek professional financial advice if considering this company for your portfolio.

The mine scoping study should be finished by the end of December with first ore production planned for June 30, 2017.

Negotiating offtake agreements will be an important milestone in terms of gaining buyer recognition of product quality, providing visibility of revenues and potentially placing the company on a solid footing in terms of raising capital to progress the project.

On this note, management said it is in offtake discussions with more than five Asian lithium carbonate and lithium hydroxide producers and it expects agreements to be completed prior to December 31.

While PSC’s shares opened slightly higher on Monday morning it could be argued that confirmation of offtake agreements will be the most significant share price driver given that the market already is aware of the quality of the resource and the fact that management has flagged production for the middle of 2017.

That said, upcoming drilling results will provide a lead as to the quantum of the mineral resource which will be important in terms of assessing the commercial viability when completing the scoping study.

Examining PSC’s historical share price performance, there may have been some profit-taking over the last few months given its shares increased approximately four-fold from 1.8 cents to 7.1 cents between June and July.

While the recent retracement could be deemed a buying opportunity it should be noted that past share price performance is no indication of future trading patterns and this should not form the basis of an investment decision.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.