Promising news on the graphite and base metals fronts drives Peninsula Mines higher

Published 16-AUG-2017 14:57 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

A double dose of good news over the last two days has resulted in the share price of Peninsula Mines (ASX: PSM) rallying 20%.

Of course it should be noted that share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

The developments which have sparked interest in the company relate to different areas of its operations in South Korea.

On Tuesday, PSM announced that it had signed a non-binding Memorandum of Understanding (MoU) with Canadian Stock Exchange listed DNI Metals Inc that envisages the formation of a co-operative joint venture to initially supply (and potentially develop and produce) up to 20,000 tonnes per annum of large flake graphite concentrate to South Korean end users.

DNI has large flake graphite projects in Madagascar which could see the company’s co-operate to supply up to 20,000 tonnes per annum of flake graphite concentrate from calendar year 2018.

DNI owns one commercially permitted, saprolite-hosted, predominantly large-flake graphite deposit in eastern Madagascar, the Vohitsara Project, and has signed a Letter of Intent (LOI) to purchase a second, adjoining, graphite deposit.

It is important to note in terms of the MoU’s references to external sourcing of graphite concentrate, that DNI also has a graphite wholesale business in which it buys and sells high quality flake graphite. This business has shown a steady increase in volume over the past year.

Under the terms of the agreement, the parties could source concentrate from locations other than Madagascar which also encompasses potential supply to Korean expandable graphite producer Graphene Korea Co.

Aside from generating near-term income this development has the potential to provide a springboard for commercialisation arrangements in relation to production which may stem from PSM’s existing graphite tenements, as well as those that are currently at the application stage.

By way of background, PSM also signed a separate Memorandum of Understanding (MoU) with Graphene Korea in June which is also non-binding, but envisages long-term strategic co-operation regarding the offtake of graphite concentrate.

Importantly, this arrangement also could see PSM receive assistance in relation to the development of graphite mining and processing both within and outside South Korea.

Peninsula commences drilling highly prospective Copperhead target at Chilbo

News that PSM had commenced drill testing the highly prospective Copperhead target, part of the Ubeong project also located in South Korea sparked further interest in the stock on Wednesday with its shares up nearly 10% in morning trading.

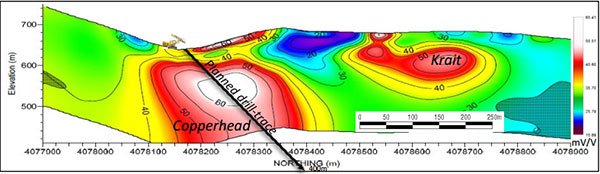

Management explained that Copperhead is considered highly prospective for porphyry copper-gold mineralisation, as well as zinc-lead-silver skarn mineralisation. Initial drilling is testing the high chargeability anomaly initially detected in IP surveys.

The 3D Inversion modelling of the IP chargeability anomaly by Southern Geoscience Consultants indicates that the possible disseminated to semi-massive sulphide body has east-west and north-south dimensions as indicated below.

The initial drillhole is planned to intersect the Copperhead sulphide target zone from 50 metres to at least 300 metres downhole, continuing to more than 400 metres where it is expected to intersect intrusive rocks below the interpreted sulphide target. Further drilling may then be carried out from the same site subject to initial results.

Drilling is also planned to test the Taipan and Cobra targets where XRF soil sampling results indicated significant and broad, northeast-southwest oriented zones of highly anomalous zinc-lead-silver and copper mineralisation in the outcropping part of the skarn-limestone unit.

Promising high grade rock chip sample results of up to 48.8% zinc and 958 grams per tonne silver, as well as 27.9% zinc, 13.85% lead and 1.1% copper were identified at Taipan. Grades of up to 25.6% zinc, and up to 215 grams per tonne silver, as well as copper mineralisation grading up to 2.3% was delineated at the Cobra system.

Consequently, there is substantial upcoming news flow from PSM’s South Korean projects, and as indicated by the spike that has occurred in the last two days, this has the potential to trigger a significant rerating.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.