Promising historical results at Superior Lake Resources’ zinc-copper project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Superior Lake Resources Limited (ASX:SUP) is steadily working towards the implementation of its redevelopment strategy for the Superior Lake Zinc Project, with historical data compilation and verification ongoing as part of the project timeline.

The initial focus of this program of work is the compilation of historical Pick Lake drill-hole data which is currently being undertaken by SUP. These results will form part of an initial Resource Estimate pegged for Q2 2018.

The strategy should also lead to a 3D geological model by the end of Q2 2018, with a full validation process inclusive of drill hole collar pick-ups, re-sampling and assaying of core also planned for Q2 2018.

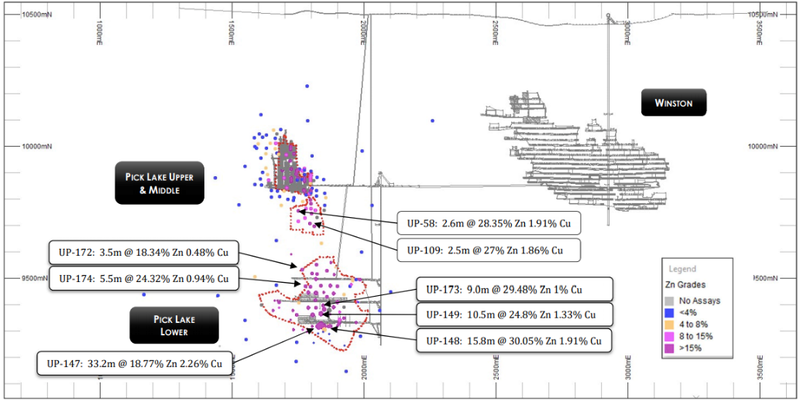

So far, outstanding historical drill results within the un-mined area of Pick Lake Mine have shown significant intercepts (excluding gold and silver credits) including:

- UP-58: 2.6m @ 28.35% Zn 1.91% Cu

- UP-172: 3.5m @ 18.34% Zn 0.48% Cu

- UP-174: 5.5m @ 24.32% Zn 0.94% Cu

- UP-147: 33.2m @ 18.77% Zn 2.26% Cu

- UP-109: 2.5m @ 27% Zn 1.86% Cu

- UP-173: 9.0m @ 29.48% Zn 1% Cu

- UP-149: 10.5m @ 24.8% Zn 1.33% Cu

- UP-148: 15.8m @ 30.05% Zn 1.91% Cu

A 3D geological model defining a Resource Estimate as well as brownfields exploration targets are scheduled to be completed during Q2 2018.

CEO, Mr David Woodall commented on today’s announcement. “In less than three months since consolidating the Superior Lake Zinc Project, the historical results provide us confidence that this project will again become the highest-grade zinc producer in Canada,” he said.

It should be noted that SUP is an early stage play and anything can happen, so seek professional financial advice if considering this stock for your portfolio.

Once SUP’s redevelopment strategy and subsequent 3D geological model of existing Resources has been completed, the company will commence a drilling program targeting a JORC 2012 Resource to support the commencement of production.

Long-section view of Pick Lake and Winston Lake underground workings with drill-hole intercepts at Pick Lake. Mine development & stopes (grey), 1998 foreign non- JORC (2012) estimate extents (red dashed line).

Once SUP has created a 3D geological model for the Super Lake Zinc Project this will allow for the planning and implementation of a brownfields exploration program to commence in Q3 2018.

This program will look to confirm historical drill information and target a JORC 2012 Mineral Resource Estimate to support the redevelopment of the project.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.