Plymouth Minerals releases maiden JORC lithium-tin resource at San Jose

Published 25-MAY-2017 09:50 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Plymouth Minerals (ASX: PLH) has released the maiden JORC lithium-tin resource in relation to its joint venture San Jose project in Spain.

The inferred and indicated resource based on a 0.1% lithium cut off is 93 million tonnes grading 0.6% lithium oxide and 0.02% Sn (tin). This represents a 16% increase on the previous non-JORC foreign estimate of mineralisation.

Based on a 0.35% lithium cut off, the resource is 16.5 million tonnes grading 0.9% lithium oxide and 0.04% Sn.

Mining industry consultants, Snowden anticipates that the mineralised slates will likely be mined using bulk mining methods and should this form of processing be applied, it is of the view that reporting the mineral resource using a 0.1% lithium cut-off grade is appropriate.

It must be noted though that like many early stage mining plays, today’s stock should still be considered a speculative investment and investors should seek professional financial advice if considering it for the portfolio.

With regard to the prospects for future resource expansion, the deposit is open along strike and at depth with a large exploration target.

Plymouth can earn up to 75% of San Jose by completing feasibility study

Commenting on this important development, PLH’s Executive Chairman, Adrian Byass said, “Release of the maiden JORC resource statement demonstrates that San Jose is a world-class asset with lithium mineralisation amenable to a simple open pit mining operation in an infrastructure endowed part of Europe.”

In looking to the future, Byass noted that this provides a platform for the next phase of work which is based on finalisation of confirmation test work and open pit optimisations prior to lodgement of the Mining Licence Application planned for September 2017.

PLH has partnered with the large Spanish company Sacyr and its wholly owned subsidiary Valoriza Mineria in an earn-in JV. Plymouth can earn up to 75% of San Jose by completing a Feasibility Study within 4 years (approximately A$6 million in spend).

San Jose is a highly advanced lithium project which is hosted in lithium-mica. A feasibility study completed in 1991 defined an open pit mining operation and a process flow sheet which produced lithium carbonate through acid-leach processing.

Lithium carbonate to be produced on site at San Jose

PLH has two factors working in its favour in relation to the San Jose project – a large exploration target which will be drilled with a view to expanding the resource, and secondly, the ability to directly convert lithium bearing micas to lithium carbonate on site.

This bypasses the requirement to trade in concentrate with off-site convertors. A feature of the lithium mineralisation at San Jose is that it is hosted in a massive, replacement style deposit with cross cutting tin bearing quartz veins, similar to other large lithium-tin deposits in Europe which are currently in production.

Plymouth and its Spanish Joint Venture partner (Valoriza Mineria) intend to produce lithium carbonate (LCE) on site. Previous drilling and process test work contained in an historical feasibility study that was recently acquired by Plymouth was based on producing lithium carbonate on site utilising open pit mining and acid leach technology.

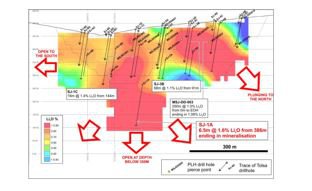

With regard to the size of the exploration target, the deposit has not been closed off by drilling, and mineralisation remains open along strike and at depth, being host to very wide zones of mineralisation. Lithium mineralisation extends from surface to in excess of 350 metres vertically and in excess of 500 metres along strike.

Mining industry consultants, Snowden has conjecturally derived an Exploration Target for San Jose, based on the observed geology to the southern side of the syncline that hosts the Mineral Resource Estimate.

Snowden observed that identical lithology and alteration exists on the southern flank of the syncline and that tin mineralisation has been historically exploited in the same manner as it has on the northern side of the syncline.

Snowden is of the view that the only geological reason for lithium mineralisation not being identified in this area is that it has not been drilled in recent years.

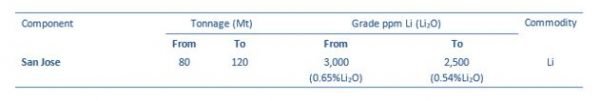

Based on Snowden’s assumptions and bearing in mind that the mining consultant’s estimates by its own admission are conjectural in nature and as such speculative, a potential Exploration Target as listed below could potentially lead to a significant expansion of the San Jose project.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.