PFS for Mt Carrington gold–silver project confirms viability

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

White Rock Minerals (ASX:WRM) last week released the key results of its Pre-Feasibility Study (PFS) into the development of the first stage of its Mt Carrington gold and silver project in NSW.

The study confirms not only the financial viability but the technical viability of the initial project development at Mt Carrington, resulting in a strong rationale for advancing the project to the next stages including a Definitive Feasibility Study (DFS). Findings indicate the project will first focus on gold prospects, and then silver down the track. The PFS also declared a Maiden Ore Reserve of 3.47 million tonnes at 1.4g/t gold for 159,000 ounces gold.

The study produced several key changes to the company’s understanding of its Mt Carrington project when compared with the 2016 Scoping Study, including an extension of the mine life from an initial three years to four and a half years; a production rate increase of 25 per cent; a 30 per cent increase in gold production to 35,000 per annum; the total gold produced increased by 59 per cent to 148,000 ounces gold over the initial Gold First Stage.

Technically sound and financially viable project

The PFS findings provide a strong rationale towards advancing Mt Carrington, from both technical and financial vantage points, with the potential to generate in excess of A$36 million undiscounted cash flow over the initial four and a half years’ Gold First mine plan, including a strong Internal Rate of Return (IRR) of 34 per cent.

The total forecast capex of the project was declared at A$35.7 million including a A$4 million contingency, with the study estimating an average all-in sustaining cost (AISC) of A$1,236 per ounce over the initial life of mine.

The development plan evaluated in the PFS relates to the first three gold-only production open pits and a conventional whole-of-ore leach process plant with an annual throughput of 1 million tonnes.

The PFS also indicates the significant potential upside in further silver production as well as ongoing gold and silver exploration.

However, any numbers here would be speculative at this stage so investors should seek professional financial advice if considering this stock for their portfolio.

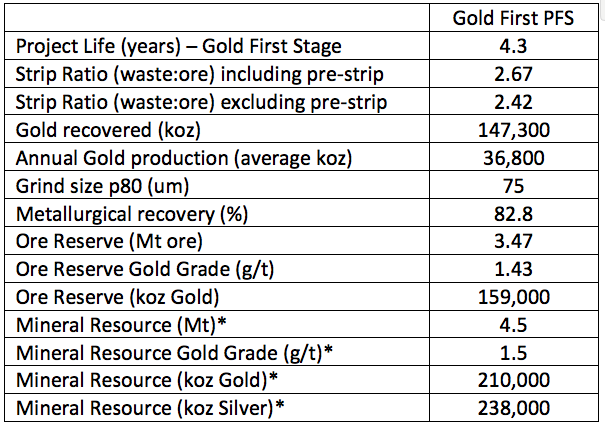

The below table shows the key physicals outcomes of the PFS:

Source: White Rock Minerals

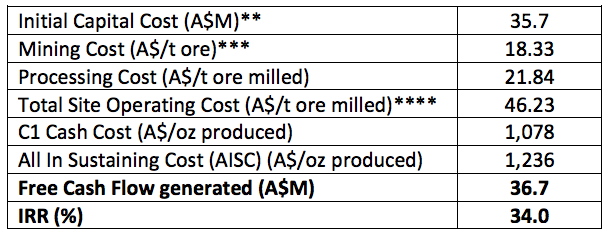

This table shows the key financial outcomes of the PFS:

Source: White Rock Minerals

Stage One approved, with WRM considering Stage Two

As WRM’s board has now approved the Stage One PFS and determined the best ‘go-forward’ case, the Definitive Feasibility Study (DFS) can now commence (subject to funding).

As mentioned earlier, Stage One of the mine plan designates Mt Carrington’s gold prospects as top priority. The project’s silver-dominant Resources — containing approximately 8.3 million ounces in the Indicated category — is the subject of further mineralogy studies, metallurgical test work and concentrate sales discussions.

The mining of the silver-dominant Resources will constitute Stage Two of the project, which will provide the opportunity to potentially increase the scale and overall life of mine, at minimised costs. The company is currently undertaking further study into the potential of Stage Two at Mt Carrington.

The technical analysis undertaken as part of the PFS was completed with the assumption of a US$1,275/ounce gold price and a foreign exchange rate of AUD:USD 0.75.

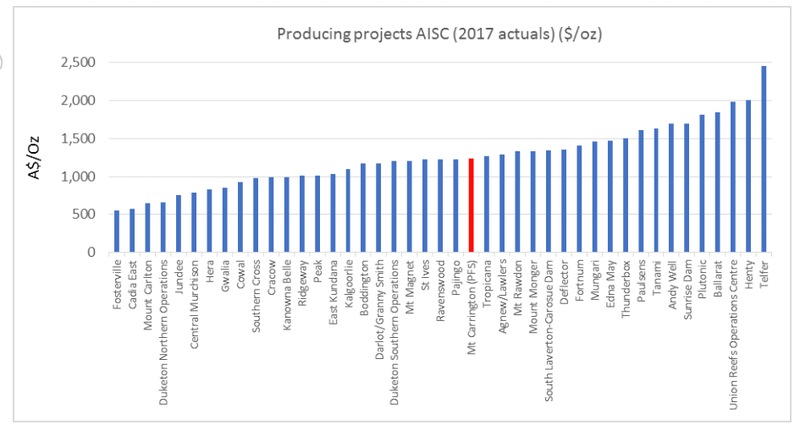

Importantly, a peer group comparison pits WRM’s gold-silver project within a middle range of All In Sustaining Costs (AISC), as indicated in the graph below.

Selected Australian gold producers AISC. Source: DJ Carmichael, S&P Market Intelligence, Company announcements

In its announcement, WRM stated that it views the Mt Carrington Gold First Stage One as a solid and ‘deliverable’ project.

Managing Director and CEO Matt Gill said: “The Board is delighted to approve the Mt Carrington PFS and also the commencement of the Definitive Feasibility Study. Now that the PFS results are in we can see a modest capex and opex way to deliver real value from the project for our shareholders.

“This is likely to be the first of several stages to fully explore and exploit the valuable resources that we have at Mt Carrington. The initial 4 1⁄2 year gold first stage will deliver over A$36 million in free cash flow and provides our shareholders with a 22-month payback and solid return on investment. Subsequent stages of the project will require additional study and investment and are expected to yield similar positive results.

“The Mt Carrington resource base also includes over 8 million ounces of silver in the Indicated category and this resource is expected to be the basis of Stage Two of the project. WRM will ensure that every opportunity to improve project scale and return on investment will continue to be examined and pursued.

“We thank all our stakeholders especially all of our local communities and major shareholders for working so closely with us to see the strong possibilities in this project for all.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.