Peninsula Mines signs MOU with emerging producer of expandable graphite, Graphene Korea

Published 14-JUN-2017 16:55 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

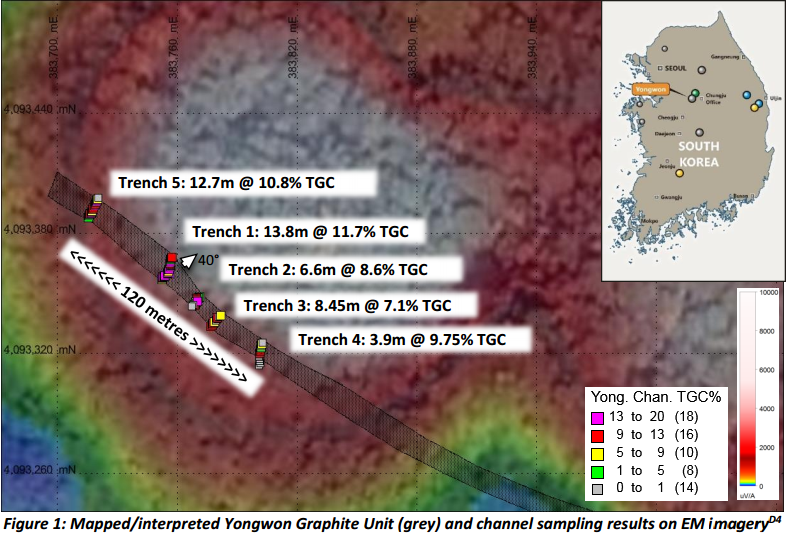

As a company with graphite exploration projects in South Korea, this is an important step for Peninsula Mines (ASX:PSM). Large to jumbo sized flake graphite has been identified at PSM’s Yongwon Graphite Project, and the associated high grade channel sampling results have provided management with a significant degree of confidence regarding the prospect of producing high purity concentrate from this source.

The Daewon Graphite Project is PSM’s other asset. Highly oriented graphite flakes have been identified, and while initial metallurgical flotation results are encouraging, final results will be reported shortly.

In addition, tenement applications have been made over several new flake-graphite projects in Korea, where previous government survey work identified flake crystalline graphite. Rock chip sampling is in progress on several of these projects and results and more details will be provided when available.

However, it is an early stage of PSM’s development and if considering this stock for your portfolio you should take all public information into account and seek professional financial advice.

MOU with high-technology focused Korean graphite end-user a coup for Peninsula

Under the terms of the Memorandum of Understanding, PSM and Graphene Korea will work together to identify projects that can potentially produce flake-graphite concentrate that will meet the specifications for production of Graphene Korea’s expandable graphite product.

Metallurgical samples from selected projects will be provided to Graphene Korea for test-work at their pilot facility south-west of Seoul and, based on positive results, projects will be prioritised for drilling and development.

In highlighting the significance of the MOU, PSM’s Managing Director, Mr Jon Dugdale, said, “This agreement represents a significant milestone for the Company, in securing the first offtake and development cooperation MOU signed with a high-technology focused Korean graphite end-user”.

In particular, Dugdale highlighted the fact that the MOU fits very well with PSM’s strategy to establish relationships with Korean graphite end-users and investors, allowing the company to prioritise development of projects that have the metallurgical characteristics that meet the end-user’s required specifications.

In order to facilitate the development of selected graphite projects, PSM is establishing a new subsidiary, Korea Graphite Co., Ltd. (“Korea Graphite”), that will house the company’s graphite projects, seek Korean investment to advance those projects, and potentially source suitable concentrate for end-users such as Graphene Korea.

This will make PSM’s graphite business a much cleaner and more attractive investment proposition, as it will be unaffected by the company’s investments in other precious and base metal projects in South Korea.

Graphene Korea establishing new plant for the production of expandable graphite products

Importantly, Graphene Korea is close to commissioning an expandable graphite products processing facility near Eumseong in Korea, approximately 20 kilometres to the west of PSM’s Yongwon Flake-Graphite Project.

Expandable graphite is processed to produce heat resistant, very light weight, non-toxic building materials and insulation products that will enable the Korean building products industry to meet increasingly stringent fire safety codes for foam insulation panels, fillers and coatings.

The product utilises flake-graphite concentrate with certain metallurgical characteristics such as expandability, and Graphene Korea will have initial demand for approximately 20,000 tonnes of flake-graphite concentrate per annum.

Graphene Korea is also planning to establish a second processing facility to produce other products, including graphene, for new technological applications requiring superconductors.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.