Peninsula Mines progresses dual graphite projects in South Korea

Published 17-MAY-2017 14:36 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Peninsula Mines (ASX: PSM) has released further high-grade channel sampling intersections from five trenches sampled at the Yongwon graphite project in South Korea.

PSM is gaining a valuable understanding of mining in South Korea as it progresses a number of projects, also in the lithium, precious metals and base metals areas.

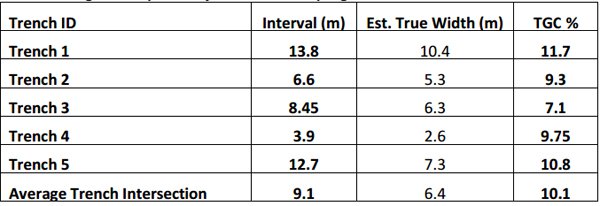

The latest results feature extensions to the original Trench one and Trench five data as highlighted below.

The high grade graphitic unit at Yongwon had been sampled across the exposed portion of the unit in five previous Korean Resources Corporation (KORES) trenches along a 120 metre strike length at surface.

Importantly, PSM noted that electromagnetic surveys indicated a strike length of more than 400 metres and down dip extensions of between 200 metres and 300 metres.

The average channel intersection width of 9.1 metres converts to an approximate true width of 6.4 metres and a high weighted average grade of 10.1% total graphitic carbon (TGC). Further examination of the broader area indicated that potentially low stripping ratios could be applied if the deposit was developed as an open pit/quarry.

Previous metallurgical testing produced high purity concentrate results, averaging 97% TGC and 87.3% graphite recovery. PSM now plans to progress metallurgical testing to determine spherical graphite production potential with a view to selling into the lithium ion battery market.

Management expects this will assist in ongoing discussions with potential offtake partners in South Korea, home to many of the large battery manufacturers and producers of end products that require power storage devices.

However, PSM represents an early stage play and therefore investors should seek professional financial advice if considering this stock for their portfolio.

Advanced metallurgical test work being undertaken at Daewon graphite project

PSM is undertaking advanced metallurgical test work in relation to the company’s second key flake graphite project in South Korea.

Preliminary flotation testing of samples from the Daewon Graphite Project has been encouraging, and nine new metallurgical samples totalling more than 50 kilograms have been collected for detailed metallurgical testing.

The combined weighted average analysis grade was 9% TGC. PSM said that a process of multiple stages of low-impact grinding and flotation, along similar lines to the successful Yongwon process would be undertaken in order to optimise concentrate grade, targeting in excess of 95% TGC.

Should the results prove encouraging, the program will be fast tracked to include mapping, channel sampling and electromagnetic geophysics to define drilling targets as the project benefits from being situated alongside an operating limestone quarry.

From a broader perspective the company’s aim is to establish a critical mass of flake-graphite resource potential for downstream processing in Korea, the world’s leading market for lithium ion battery production. Achieving this goal will position the company ideally in terms of attracting offtake and investment partners.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.