Peninsula Mines intersects graphite at Eunha North

Published 21-JUN-2018 12:48 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

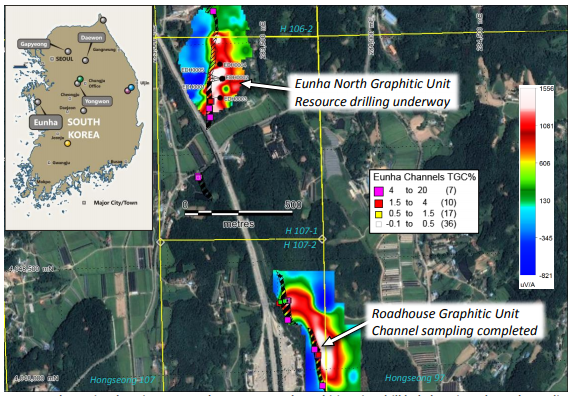

Peninsula Mines (ASX:PSM) has reported that four out of five initial drillholes at Eunha North in Chungham Province, South Korea, have intersected thick, potentially high-grade graphite.

A total of 488.9m of diamond drilling has been completed to date across the five drillholes, with visually estimated graphite intersections as follows:

- EHD0001: 9.38m (6m TW) from 89.71m of potentially high-grade (>10%) graphite

- EHD0003: 20.32m (14m TW) from 57.88m of potentially high-grade (>10%) graphite

- EHD0004: 10.72m (7m TW) from 28.96m of potentially high-grade (>10%) graphite

- EHD0005: 12.82m (8m TW) from 66.18m) of potentially high-grade (>10%) graphite

Initial drilling indicates that the EM anomaly at Eunha North is related to a steeply west dipping graphitic unit, averaging ~10m true width of potentially high-grade (>10%) graphite (visual estimates).

The intersections will be logged for total graphitic carbon (TGC) analysis and flake distribution prior to further drill work, which will define a maiden Mineral Resource.

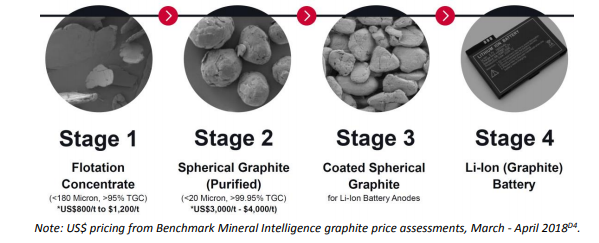

In addition to resource drilling at Eunha, a >5kg, high-grade concentrate sample (>95% TGC) is close to generation.

This sample will be sent to a German spherical graphite processing specialist for spherical testing – including micronisation (to <20 micron) and spheronisation – which will incorporate CSIRO technology with the objective of generating a >99.95% TGC uncoated spherical graphite product for lithium-ion battery anode production in Korea.

According to PSM, the production of spherical graphite will increase the potential value of its graphite product from a current market price for fine flake graphite concentrate (>94-95%) of ~AUD 1,000/t to over 4,000 AUD market price for uncoated, purified (>99.95%) spherical graphite.

It should be noted that this remains a speculative stock, despite the strength of the current market price and investors should take all publicly available information into account if considering this stock for their portfolio.

The company has noted that foreign investment incentives (leasing and power discounts) are on the table if it were to construct a spherical graphite production facility at a key industrial site at Dangjin Port in Chungham Province.

In addition to the above drill work, channel sampling has been completed across the Roadhouse graphite unit, on an average 40m spaced sections. A total of 81 samples will be processed at Nagrom laboratories in Perth, with results to be reported prior to drill target selection.

PSM Managing Director Jon Dugdale commented on the update, “The initial intersections of thick and potentially high-grade graphite at Eunha North are a key first step towards defining a mineral resource for potential development and concentrate production.

“The ultimate objective, however, is to take the graphite processing a step further – to produce high-purity spherical graphite on the doorstep of the Lithium-Ion battery industry in South Korea.”

In addition to the above drill work, channel sampling has been completed across the Roadhouse graphite unit, on an average 40m spaced sections. A total of 81 samples will be processed at Nagrom laboratories in Perth, with results to be reported prior to drill target selection.

About Peninsula Mines

Peninsula Mines is an Australian listed exploration and development company focused on mineral discovery and production in South Korea.

The company has operated in the country for over five years, and now features an established network of key contacts.

South Korea is one of the world’s largest producers of lithium-ion batteries, but imports graphite products such as spherical graphite for lithium-ion battery anodes.

PSM has identified a key opportunity to produce spherical graphite in South Korea, with the intent to directly supply lithium-ion battery manufacturers and other graphite end-users within the country.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.