Peninsula Mines identifies high proportions of super jumbo and jumbo flake graphite

Published 20-OCT-2017 11:47 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

To put this into significance, super jumbo and jumbo flake graphite traditionally carries far larger value than small/medium graphite flakes due to their suitability for commercial applications.

As a backdrop, previously reported surface exposures of graphitic units at the Chugwang Project ranged from 13 per cent to 50 per cent Total Graphitic Carbon (TGC) over a 1 kilometre strike length.

Three rock-chip samples collected by PSM in the vicinity of a previous mining and processing operation produced very-high grade results ranging between 16.2 per cent and 24.4 per cent with an average of 20 per cent.

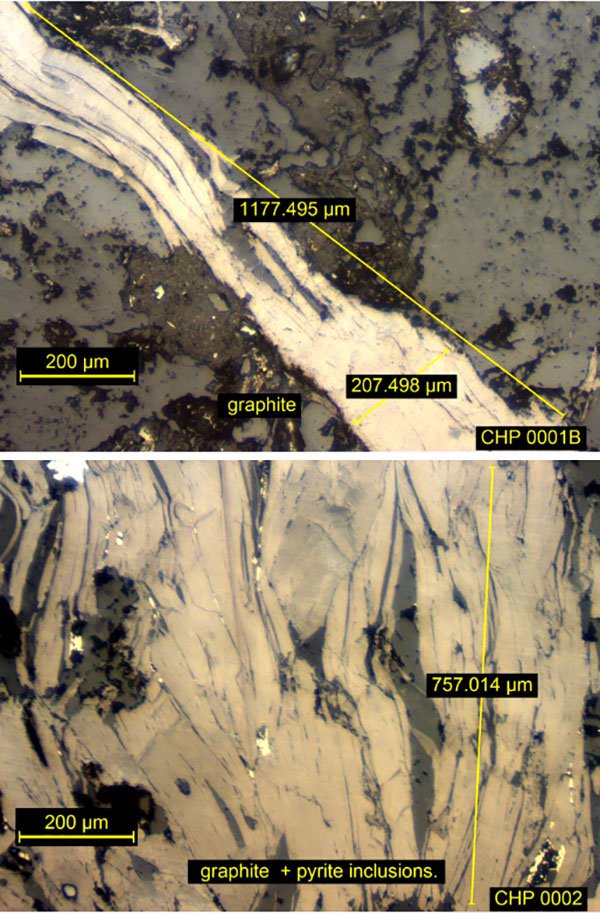

In highlighting the technical features of the mineralisation, PSM’s managing Director, Jon Dugdale said, “Polished thin section petrography conducted by Townend Mineralogy Laboratory in Perth on the Chugwang samples identified coarse single flakes and sometimes bunches with long dimensions frequently exceeding 750 micron and widths of more than 100 micron.”

Whilst this is good news, it should be noted that PSM is an early stage play and investors should seek professional financial advice for further information if considering this stock for their portfolio.

This is illustrated in the following photomicrographs. To put these in perspective, industry reporting has classified large flakes as more than 180 micron in length, Jumbo flakes as >300 micron in length and “Super Jumbo” as more than 500 micron in length.

Flakes in excess of 1000 micron suitable for graphite building products

The presence of flakes frequently exceeding ‘super jumbo’ size, including flakes over 1,000 micron is very encouraging as the material is highly likely to be suitable for production of high-purity, large-flake graphite concentrate required by the fast-growing market in

South Korea for non-flammable, expandable graphite building products.

Petrography has also been conducted on samples from the nearby Eunha Project where

a rockchip sample result of 19.3 per cent TGC was obtained from a graphitic unit that previous mapping had identified over a 1.3km strike length.

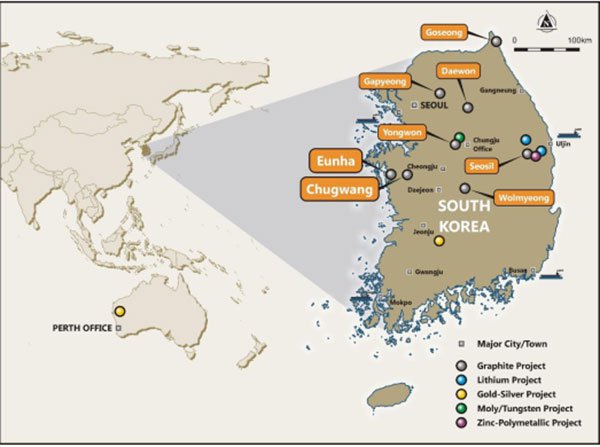

As can be seen in the following map outlining PSM’s large range of projects in South Korea, Eunha is in close proximity to the Chugwang graphite project, a factor that could work in the company’s favour in terms of producing large scale quantities should the projects be commercially viable.

Importantly, the petrography on the Eunha sample identified a minor population of micron flakes in excess of 500 with widths between 50 and 100 micron. This has prompted management to progress mapping and channel sampling across the graphitic units at

Chugwang and Eunha as soon as possible, as well as conducting initial metallurgical testing to determine the potential for large-flake graphite concentrate production.

PSM had previously signed an offtake Memorandum of Understanding (MOU) with Korean expandable graphite producer, Graphene Korea Co. Ltd, that required initial supply of up to 20,000 tonnes per annum of large flake (+180 micron), more than 95 per cent TGC graphite concentrate for the production of non-flammable, light-weight, expandable graphite building cladding products for which demand is rapidly growing in Asia.

Commenting on the exploration success and its significance in terms of commercial agreements, PSM’s Managing Director Jon Dugdale said, “We are very pleased to have identified potential for large to jumbo-sized flake graphite concentrate production in Korea, an important development given that Peninsula Mines is on the doorstep of the world’s largest market for high-growth expandable graphite and lithium-ion battery production”.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.