Pending resource update by European Lithium a potential share price catalyst

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

As the S&P/ASX All Ordinaries index plunged nearly 300 points in the last fortnight the share prices of a number of smaller more speculative stocks were hard hit.

As is normally the case this has created buying opportunities, and one standout stock in European Lithium (ASX:EUR) that appears to be on the verge of delivering a substantially better than expected resource upgrade may be worth targeting.

Not surprisingly, shares in EUR while coming off slightly have found support with Tuesday’s opening price of 6 cents representing a rebound to where it was trading prior to the broader market sell-off.

Exploration results provide confidence in prospect of significant resource upgrade

It was no coincidence that this chimed in with the release of promising exploration results from its Wolfsburg lithium project in Austria. The delineation of thick high-grade lithium intersections grading up to 3.35% lithium dioxide is extremely encouraging given that the company is building on a resource that currently has an average grade of 1.5%.

It is important to note that the current average grade is well above those proven by most emerging players and current producers. Consequently, if EUR were to confirm a more expansive resource at that grade it should provide significant share price momentum.

Given returns from drilling to date one would expect a substantial increase in resource from the current 3.7 million tonnes, particularly in light of the fact that upbeat results released on Monday are consistent with the promising data that stemmed from assay results released last week where the average grade of samples from amphibolite veins was 1.8%.

Early signs of share price support

Importantly, drilling results not only confirmed the validity of assay results, but painted an even brighter picture with widths up to 4.26 metres grading 1.44% lithium dioxide and other sizeable intersections including 3.3 metres grading 2% lithium dioxide.

Providing further interest was the data captured from mica schists which last week wasn’t as promising as samples from amphibolite. However, the largest width (referred to above) was from a mica schist where the grades substantially exceeded last week’s average of 1.3%.

There were other standout mica schist drill results including 3.6 metres grading 1.4%. The upshot of these results taking into account the broad range of data would appear to be a substantially increased resource.

However, it is impossible to draw firm conclusions regarding resource definitions from exploration results, and investors considering this stock should seek professional financial advice and not make investment decisions on such assumptions alone.

EUR grades well ahead of peers

The key takeaway in an industry where grade is king and a major determinant of a project’s commercial viability is the average grade. This is where EUR is tracking well ahead of its peers.

For example, Galaxy Resources’ hard rock assets in Canada and Australia have grades of 1.2% and 1.08% respectively. Pilbara Resources’ (ASX: PLS) Pilgangoora project has a measured, indicated and inferred resource grading 1.22% lithium dioxide.

Perhaps an indication of the importance of grade was the share price response to PLS’s Definitive Feasibility Study (DFS) which was released in September. It was based on an updated ore reserve for Pilgangoora of 69.8 million tonnes grading 1.26% lithium dioxide.

The company’s shares immediately slid from a high of 59 cents on the day of the announcement to an intraday low of 48.2 cents on the following day, before trading as low as 40.5 cents in mid-October.

While it can’t be predicted how EUR’s share price will respond to the release of its updated resource, the fact remains that current grades are in excess of those that PLS had to work with in terms of determining the economic viability of Pilgangoora.

Secondly, exploration results to date at least backup the likelihood of the group maintaining grades at 1.5%, if not underpinning an increase in grade, suggesting the resource could be one of the most economically viable global lithium projects.

The economics of Wolfsburg is further enhanced by its proximity to end markets in Europe, a net importer of lithium.

Will EUR do a Berkeley

This week Berkely Energia (ASX: BKY was the subject of a substantial share price rerating as it was recognised as Europe’s only major uranium mine, sitting at the bottom of the global cost curve.

The question is whether EUR will emerge next week as one of the potentially lowest cost lithium producers on the doorstep of major European industrial hubs such as Germany.

Furthermore, management’s timeline would see it chime in perfectly with the establishment of lithium battery gigafactories, which are already being considered by both tech companies and car manufacturers for locations in Europe.

EUR out of the blocks quickly

With regards to timing, EUR is in a better position than most new players and many emerging producers because Wolfsburg has a proven resource and existing exploration data.

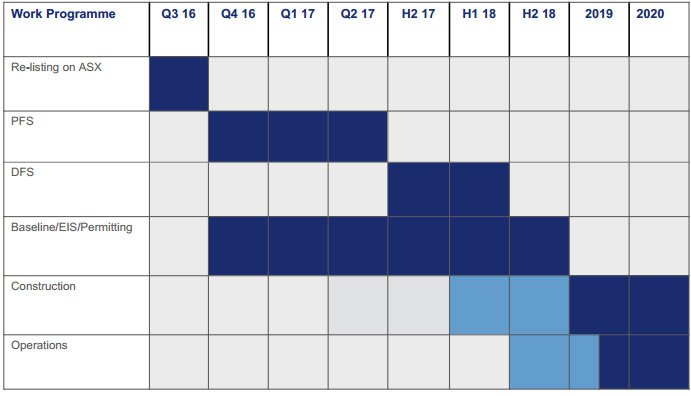

Consequently, as can be seen below, management is targeting prefeasibility and definitive feasibility studies to occur in 2017 with a view to commencing construction by the first half of 2018.

As next week’s updated resource information draws closer, investors considering this stock should be watchful of share price movements. Interestingly, they traded more than 5% higher on Tuesday under particularly high volumes.

However, historical trading patterns are not an indication of future share price performance, and investors should seek independent financial advice if considering this stock.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.