Mustang’s graphite-vanadium project on track for first production in mid-2019

Published 15-MAR-2018 12:40 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. FinFeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Mustang Resources (ASX: MUS) has today informed the market that a strategic review led by new Managing Director, Dr Bernard Olivier has found that the company’s Caula Graphite Project in Mozambique is on track for first production by the middle of next year.

Importantly, the review found that Caula has a high level of potential to produce high-value vanadium products, which would add excellent cash flow opportunities for the company.

Further, the review established that Stage 1 of Caula will produce vanadium concentrate which can be either sold or stockpiled for further processing to high-purity vanadium products as part of Stage 2.

The strategic review was conducted alongside a Concept Study, which the company states is set for completion in the June 2018 quarter.

Of course, as with all minerals exploration especially in high-risk regions such as Africa, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

Dr Evan Kirby recently joined the Mustang Board of Directors as a Non-Executive Director and consultant, bringing considerable graphite and vanadium experience. This was put to good use as Dr Kirby assisted Dr Olivier in the strategic review, together arriving at the following key findings:

- Caula contains an exceptional combination of graphite, both high-grade (13% TGC) and large flakes sizes (~55% large, jumbo and super jumbo).

- Concept Study is on track for completion by Q2 2018.

- The vanadium content of the ore represents an additional cash flow opportunity, especially given the structural shift in the vanadium market.

- The most effective way to develop Caula involves a two-stage process.

The two stages, as stipulated in the report, are planned as follows.

Stage 1 Development Strategy comprises “a robust, low-cost mining operation producing ~100,000tpa of ore for 10,000 to 15,000tpa of high-grade (97% C+) graphite concentrate”. From the start of operations, vanadium will be extracted to a concentrate. This will be sold to a vanadium producer or stockpiled for future production of refined vanadium pentoxide chemicals (98% and 99%+ V2O5).

Further, the proceeds from sales of graphite and vanadium products produced in Stage 1 will be used to secure binding off-take agreements and associated finance required for Stage 2.

Stage 2 will involve the expansion of mining operations to between 300,000 and 600,000tpa of ore, and construction of a large full-scale processing plant capable of delivering 50,000 to 75,000tpa of high grade (97% C+) graphite concentrate.

It will also comprise of the construction of “a full-scale vanadium concentrate processing plant capable of producing refined vanadium products (99.9% purity vanadium pentoxide and other vanadium chemicals such as vanadium sulfate) for the fast-growing aerospace alloy and battery markets”.

The company explained that, assuming a hypothetical ore grade of 0.4% V2O5, a 600,000tpa mining operation could produce ~2,000tpa of V2O5 (98% and 99.9% purity vanadium pentoxide chemicals) with a current market value of >US$60 million p.a.

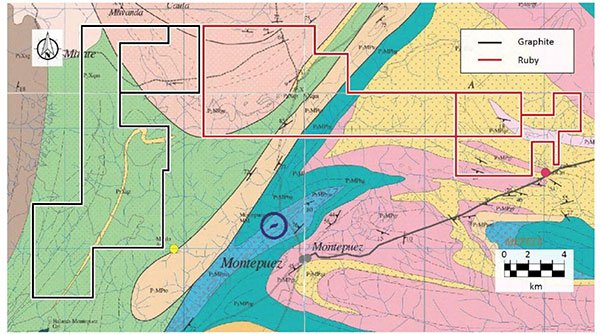

Mustang’s Caula graphite and vanadium project located adjacent to its Montepuez Ruby Project in Northern Mozambique.

Last month, MUS announced it would be raising up to A$4.43 million dollars via a one-for-four non-renounceable entitlement issue at 2.3 cents per share, to go towards exploration at the Caula project.

Friendly macro environment – vanadium and graphite

In the last 12 months vanadium’s supply and demand dynamics have seen a lot of change. The main use of vanadium across the world is as an alloying agent in full alloy and high-strength low alloy steels.

Of note is the fact that China has recently increased the minimum specification for reinforcing steel used in buildings. Consequently, domestic vanadium consumption is expected to increase by 10,000 tons per year (as reported in the Metal Bulletin, August 2017).

These factors — as stipulated in MUS’s announcement today — could mean that, if the vanadium price and graphite basket price work in the company’s favour as it predicts, Stage 1 of the development process could produce more revenue than the total all-in costs for the processing plant within the first 12 months of production.

China has shifted from being a net exporter of vanadium to a net importer, possibly due to the use of vanadium in redox flow batteries (VRFB batteries) which are used for largescale energy storage. At the same time, vanadium supplies have tightened, with the price heading sharply north in the last two years to current levels of ~US$30,500/ton. As a result, vanadium was the best performing battery metal of 2017.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.