Mustang Resources spikes 25% on back of strong ruby haul

Published 26-OCT-2016 17:30 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

Shares in Mustang Resources (ASX: MUS) spiked 25% under high volumes on Wednesday after the company announced that 460.4 carats of high-quality rubies had been recovered during the commissioning of its bulk sample mining plant at Montepuez located in Mozambique.

This is an outstanding development for the company if one considers the increase in scale that will occur in coming months.

The rubies are the first recoveries from 2683 tonnes of initial material processed as part of the commissioning phase. To put this in perspective, the plant will be ramped up to 525 tonnes per day during November 2016.

Consequently, the recoveries announced today came from a volume of material equivalent to only five days output once the plant is running at capacity.

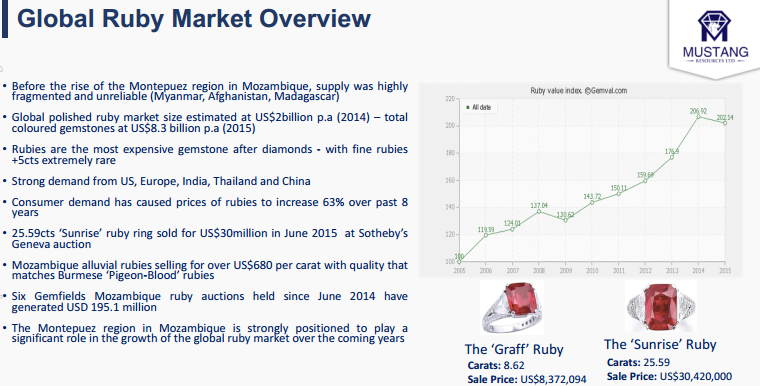

While it is difficult to place a dollar value on rubies recovered, Gemfields plc, which operates in the same vicinity as MUS, has held six rough ruby auctions since 2014 where values have ranged between US$317 and US$688 per carat for medium to high-quality rubies respectively.

In terms of quality, an initial assessment of rubies from Mustang’s Alpha deposit conducted in July 2016 confirmed that the company’s rubies were of high quality with some gemstones showing variety of colour, size and clarity.

This has provided management with confidence that the rubies being recovered will fetch market-related prices.

However, it is impossible to predict commodity prices and potential investors should not only use this data, nor forward-looking production statements when forming the basis for an investment decision. MUS is an early stage exploration company working in a region with sovereign risk and independent financial advice should be sought if considering an investment in this stock.

If one were to pick the midpoint of the value range reflected by auctions over the last two years it would imply a price of approximately US$500 per carat. Using this as a guide, a back of the envelope “guesstimate” for 460 carats of rubies is US$230,000. Once again, a note of caution – this is a very rough guide using broad assumptions.

Arguably a better perspective can be gained by a preliminary economic study which analyst RB Milestone Group referred to recently when initiating coverage on the stock.

This modelled monthly revenues of US$4.9 million from the recovery of 14,112 carats per month at an assumed average sale price of $350 per carat. This equates to revenues of circa US$60 million a year, nearly AUD$80 million – fairly impressive metrics for a company with a market capitalisation of approximately $10 million.

The broker noted that auctions are usually conducted at the end of December and the end of June, suggesting some quantitative guidance regarding the bigger picture may be available in early 2017.

Given the seemingly substantial discount to fair value, potential investors could take a lead from Baker Young analyst Dirk van Dissel. When he initiated coverage of the stock in June he said, “On the view that Mustang will achieve exploration and bulk sampling success (which as indicated today, they have) we value the company at 19 cents per share using a weighted discounted cash flow of bulk sampling/future mining operations”.

Postulating various production scenarios, van Dissel said, “It is entirely foreseeable that by the end of the year Mustang could have mined enough ruby bearing dirt to assemble a 50,000 to 100,000 carat parcel that could receive at auction tens of millions of dollars”.

His target price is broadly in line with the company’s 12 month high of 21.5 cents which interestingly was struck at a time when there was far less certainty surrounding the stock, suggesting that in the absence of regular recent news flow, it may have slipped off the radar.

While a highly speculative stock, this is as good an entry point as has been available over the last 12 months, at a time when there is a far higher degree of certainty and promise regarding the company’s outlook.

At the same time, analysts use a broad range of assumptions, which may not come true. It is not recommended that investors make investment decisions based on analyst predictions pr price targets alone. Consider a range of factors, including your own personal circumstances and risk profile.

Industry conditions are currently buoyant with the ruby market for cut/polished high quality stones reportedly fetching up to US$35,900 per carat. Note, this isn’t the price for the base gem that Mustang sells.

Management also indicated it was looking to negotiate strategic sales and marketing agreements prior to the sale of the first Mustang rubies. This could be a potential share price catalyst as it would likely provide a pricing guide, as well as earnings visibility should an offtake agreement be ratified.

The security provided by offtake agreements could also positively impact the company’s ability to finance project development.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.