Mustang finds first rubies at Montepuez project

Published 27-JUL-2016 16:18 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Mustang Resources (ASX:MUS) has recovered its first rubies from its Montepuez ruby project in Mozambique – a good sign heading into full bulk sampling in Q3.

The aspiring ruby miner told its shareholders today that it had recovered 10 rubies for a total of 2.61 carats as part of an initial trenching program at the project.

The trenching is taking place at the project in order to help firm up targets for a bulk sampling program in the third quarter of this year.

It is hoped the bulk sampling will bring up rubies which will be able to be sold to the market – ahead of full project development.

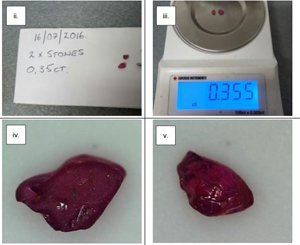

A sample of the rubies brought up by MUS

The appearance of small rubies in gravel at this stage though is thought to be a positive indicator, with MUS managing director Christiaan Jordaan saying the results were “very encouraging” at this early stage.

To date 25 samples have been taken as part of the initial trenching program – focusing on two types of gravel.

The first type of gravel did not yield any rubies, but the second lot of gravel, which was sitting on a grey clay bedrock yielded the 10 rubies – providing the company a clue on where the best chance of bringing up rubies may be.

MUS warned, however, that more mapping and pitting would be needed to firm up this hypothesis and to find the lateral extent of the ruby-bearing gravels.

Investors should note that this is still an early-stage play and full development is not guaranteed — investors should seek professional advice before deciding whether or not to invest.

About Mustang Resources (ASX:MUS)

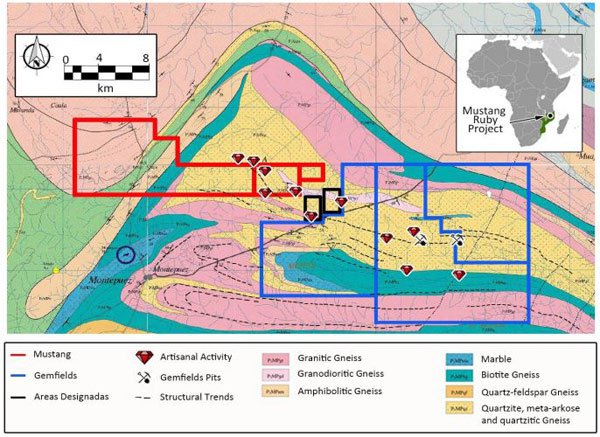

Rubies sourced from the Montepuez region are estimated to account for 40% of the total global ruby trade, making it a hot spot for the rare gemstone.

MUS’s Montepuez Ruby Project is situated next door to Gemfields PLC (GEM:LSE) who’s ruby deposit is one of the largest in the world.

Gemfields realised a total of US$150.8 million in 5 auctions for 5.98 million carats of the 18.8m carats recovered during their bulk sampling phase (2012 – 2015) over which period its market capitalisation has grown to over A$450m.

The close proximity of MUS’s project to Gemfields is likely to draw attention from investors should bulk sampling return favourable results.

MUS is well positioned to piggy back on the success of Gemfields and bring any finds to market at a rapid pace by following the Gemfields playbook.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.