Mustang back on the ruby trail with new discovery

Published 17-APR-2018 11:30 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. FinFeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Following the disappointment of its inaugural rough ruby tender results in November last year, Mustang (ASX:MUS) has been hard at work in the first quarter of 2018.

The turnaround began with the implementation of a new ruby sales and marketing strategy that led to the implementation of a sales and marketing office in Chanthaburi, Thailand in February this year. This facility is smaller and lower cost than that its previous sales facility in Mauritius and more in line with the company’s emphasis on project and ruby market development and ongoing market research.

Since then, MUS has added graphite and vanadium interests to its portfolio as a diversification tool, however rubies still play a major role in this $21 million capped company’s growth strategy.

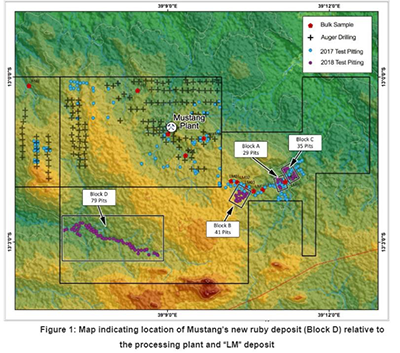

Today, MUS announced the discovery of new ruby-bearing gravels within its Montepuez ruby project in Mozambique, located just 3.5 kilometres directly south-west from its 200tph processing plant.

MUS does remain a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

The discovery comes from the extensive exploration program carried out during the March quarter which resulted in the development of 196 test pits during the period.

During the March quarter, MUS recovered a total of 29,069.1 carats from the processing of 43,940m3 (68,107tonnes) of material at Montepuez. This resulted in an average grade of 0.42carats/tonne for the quarter.

Recovery grades were approximately 13.5% higher than Q42017, while tonnes processed were approximately 15% lower due to heavy rains.

With the wet season now coming to an end, MUS has begun preparations to restart its exploration bulk sampling program and expects volumes and grades to increase in the coming quarter.

As can be seen below, the newly identified Block D will form part of the upcoming bulk sampling program.

Mustang remains the only ASX listed ruby stock and revenue generating listed ruby developer in the world. Montepuez runs adjacent to the advanced mining operations of AIM-listed multinational natural resources company Gemfields.

Mustang’s Managing, Director Dr.Bernard Olivier said: “The discovery of the Block D ruby-bearing gravels and the success of our ongoing exploration activities continue to show the significant prospectivity of the Montepuez Ruby Project. When combined with the recent initial success of our newly-implemented sales and marketing strategy, we are confident that we can continue to steadily build value around this high-quality asset– which is strategically located in the heart of the Montepuez gem-field, currently the world’s leading supply source of rubies.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.