MUS reports strong exploration and production results at Montepuez Ruby Project

Published 19-FEB-2018 12:52 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

Mustang Resources (ASX:MUS) has announced that bulk sample processing and exploration activities on its Montepuez Ruby Project, in Northern Mozambique, are delivering increasingly strong results.

MUS are working towards establishing Montepuez as a world class ruby project with consistent production and exploration upside. The announced results demonstrate that MUS is on track towards achieving this.

The ongoing exploration activities conducted during fourth quarter of 2017 and the first of 2018 have already delivered positive results. At total of 69 sampling pits were developed and processed during the period while a total of 14,502 tonnes of material were excavated and extracted as part of the bulk sampling process.

The exploration, pitting, trenching and bulk sampling programme has extended the gravel bed extension from 3.3 kilometres to 4.2 kilometres. It identified additional gravel bed targets over a 3 kilometre long river and associated tributaries system.

During the fourth quarter of 2017, MUS made significant improvements to the processing plant to optimise its efficiencies and reduce processing costs. It was able to increase average grades by more than 10% from October 2017, compared with the total average grade achieved from previous bulk sampling.

MUS is also implementing further processing, sorting and grading improvements to increase overall efficiencies.

Ongoing processing of bulk sample material since October 2017 has returned the following results:

- 80,658 tonnes processed in Q4 2017 with 29,983 carats recovered at an average grade of 0.37ct/t.

- 17,025 tonnes processed in Q1 (to date) with 7,495 carats recovered at an average grade of 0.44ct/t

As at 31 January 2018, MUS had inventory available for sale of 302,028 carats.

Of course, as with all minerals exploration especially in high-risk regions such as Africa, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

The geology team also analysed the exploration dataset and selected further targets for additional pitting. During the remainder of the current quarter, MUS’s exploration programme will focus on identifying further high-grade targets for large-scale bulk sampling excavation and processing. It will also further delineate the dimensions and ruby distribution of the deposit, which remains open in all directions.

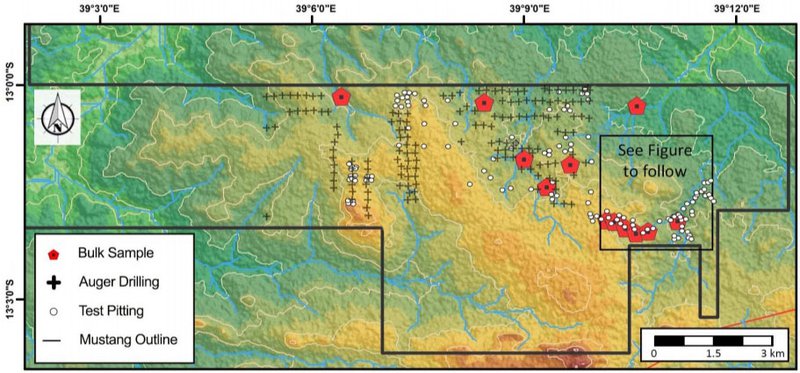

Montepuez Ruby Project tenements with sampling, drilling and pitting localities to date:

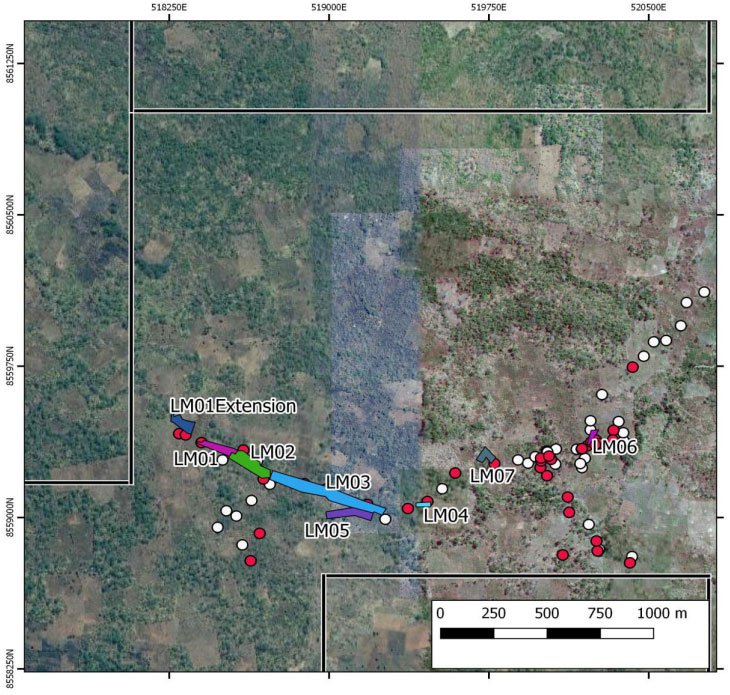

The Montepuez project area with pitting and sampling localities indicated:

The company will provide an update shortly on the progress of its marketing and sales.

MUS Managing Director Dr Bernard Olivier said, “Having spent time on site in recent weeks, I am very pleased to report that exploration, bulk sampling and processing activities on the Montepuez Ruby Project are meeting our targets. These results reflect the skills and commitment of Mustang’s motivated and experienced operational team.

“The fourth quarter 2017 plant optimisation programme is generating the intended results with further improvements and upgrades now being implemented. The overall results demonstrate that Montepuez is highly prospective and technically sound.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.