MUS receives an upgraded price target

Published 15-JUN-2016 16:19 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

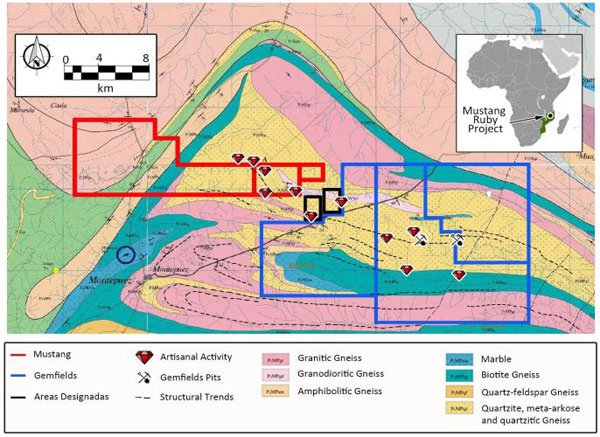

Baker Young Stockbrokers last week initiated research coverage on MUS, Mustang Resources (ASX:MUS), an ASX listed junior resource company focused on mineral exploration in Mozambique.

MUS currently holds three licenses in the highly regarded Montepuez region.

There are inherent social and political risks in this area and it can be difficult to get mining projects off the ground. If you are looking to invest in this stock, seek professional advice.

Baker Young released the detailed report on the company and its primary operation, the Montepuez Ruby Project, where MUS is currently conducting drilling and field work.

Extensive bulk sampling is planned for June to December 2016.

Given the low market capitalisation of the company, currently $6.9 million, any economic amounts of rubies found on Mustang’s projects through bulk sampling could have a positive impact on MUS’s share price, according to the report.

The research report comes with a buy recommendation on MUS and puts a 19c price target on the company, at the time of writing the company is trading at 4.1c on the ASX.

It should be noted that report comes with a caution that this is a highly speculative investment and that the past performance of this company is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The revaluation by Baker Young Stockbrokers is based on expected results from bulk sampling and expected future operations.

Analysts at Baker Young Stockbrokers believe MUS to be oversold based on selling from legacy shareholders, the market for resource exploration taking a hit in recent times and the company’s balance sheet being under pressure.

With a recent capital raising of $3.85m and ongoing Share Purchase Plan (up to $1.8m) the company appears to have its financial house in order.

The Montepuez Ruby Project is expected to generate high revenues off low capital expenditure, making it financially appealing longer term as well, should the company move to production phase.

With the financials seemingly taken care of, MUS can shift its focus on locating a commercial quantity of rubles at their tenement.

From explorer to producer

Through fast-tracking development at the Montepuez Ruby Project, MUS aims to move from a mineral exploration company to a producer over the coming months.

Should upcoming bulk sampling yield results as expected by the company, sizeable revenues could be generated in the near term.

Making the shift to becoming a producer and scaling operations easier if revenues were to start coming in early.

Located next to world-class ruby deposit

Rubies sourced from the Montepuez region are estimated to account for 40% of the total global ruby trade, making it a hot spot for the rare gemstone.

MUS’s Montepuez Ruby Project is situated next door to Gemfields PLC (GEM:LSE) who’s ruby deposit is one of the largest in the world.

Gemfields realised a total of US$150.8 million in 5 auctions for 5.98 million carats of the 18.8m carats recovered during their bulk sampling phase (2012 – 2015) over which period its market capitalisation has grown to over A$450m. Which is expected to grow exponentially once they commence full scale operations.

The close proximity of MUS’s project to Gemfields is likely to draw attention from investors should bulk sampling return favourable results.

MUS is well positioned to piggy back on the success of Gemfields and bring any finds to market at a rapid pace.

Ruby Market

The ruby market is estimated to have topped US$2 billion in 2014, with consumer demand seeing the price of rubies increase 63% over the past 8 years.

Rubies are the most expensive gemstone after diamonds, so essentially they are a woman’s second best friend.

Assuming bulk sampling success, MUS is perfectly positioned to become a major supplier for the ruby market.

Furthermore the company has the potential generate significant cashflow with relatively capital outlay.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.