Multiple EM targets at Kopore Metal’s Kalahari Copper Belt projects

Published 01-MAR-2018 12:29 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

FinFeed presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high-risk product. We stress that this article should only be used as one part of this decision-making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

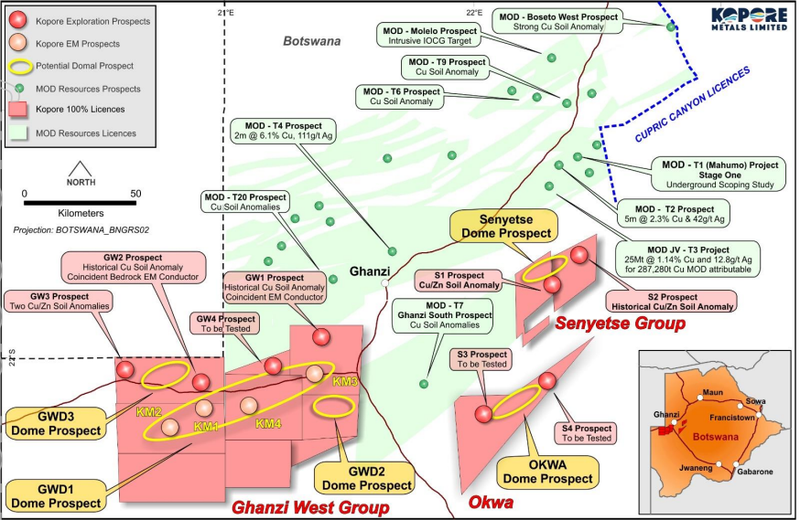

Kopore Metals Limited (ASX:KMT) has announced results of its recently completed airborne magnetic and electromagnetic survey (AEM) at its Kalahari Copper Belt projects in Botswana.

The geophysical survey, conducted for KMT by South African based NRG Exploration CC using a helicopter borne electromagnetic and magnetic survey (HTDEM) system, successfully identified four initial electromagnetic (EM) bedrock conductor primary target areas.

These conductor zones range from shallow depths below surface, of less than 50m, to deeper targets, of more than 250m, and up to four kilometres in strike length, located across its Kalahari Copper Belt Ghanzi West GWD1 prospect. The airborne magnetic and EM survey (AEM) covered an area of 1,091.7 square kilometres of the current 7,891 square kilometres of KMT’s 100% owned prospecting licences.

At the same time, it’s worth noting that this is an early stage play and investors should seek professional financial advice if considering this company for their portfolio.

KMT also reported that reprocessing newly acquired regional magnetic airborne raw data and a recent field geological reconnaissance programme confirmed the presence of the targeted D’Kar formation, over the GWD1 target.

The D’Kar formation is known to host most of the mineralisation including the substantial and regionally proximate Zone 5 (Cupric Canyon Capital) and T3 copper-silver (Mod Resources Limited) projects.

In light of the survey, KMT has reassessed its portfolio of prospects and assigned the identified GWD1 AEM targets as its first priority. This target can be seen on the regional licence map below:

The company will conduct detailed ground geophysical programmes over each of its identified EM prospects as it investigates the potential for a MOD Resources Limited T3 copper-silver project style geometry. This ground geophysical and soil sampling will commence on these targets as soon as practical.

KMT continues to review the survey results and integrate the results with its additional planned ground reconnaissance programmes and drilling. The company has designed detailed ground EM survey programmes to follow up selected prospects to help refine the targeting process and establish a better understanding of potential geometry and will subsequently be used for exploration drill targeting.

It has also commenced preparation of the Environmental Management Plan (EMP) over the EM target areas for submission to the Botswana Department of Environmental Affairs. In preparation for detailed exploration drilling programmes, KMT will conduct detailed exploration programmes using non-invasive techniques, such as ground geophysics, concurrently with the EMP submission and approval process.

KMT will evaluate the potential for further AEM programs over recently identified prospects to refocus its planned exploration drilling campaign, which subject to government approvals is expected to commence in the second quarter of 2018. KMT’s recent geophysical programme has efficiently identified multiple potential copper prospects across its substantial landholding, which the company is looking forward to exploring over the coming months.

Managing Director, Grant Ferguson said, “We are extremely pleased that our maiden airborne geophysical survey has defined four quality initial primary targets that form part of a highly prospective, interpreted large domal area, as well as identifying a number of other regional targets for follow up.

We have made significant progress on our exploration programme since acquiring our tenements in the Kalahari Copper Belt, Botswana in November 2017 with the identification of multiple new soil anomaly prospect areas, bedrock conductor zones coincident to existing soil anomalies and at its Priority 1 GWD1 prospect, the identification of favourable EM bedrock conductor zones, hanging wall D’Kar Formation and other interpreted structures consistent with other copper-silver projects elsewhere in the Kalahari Copper Belt.”

“In addition to this recent airborne survey, an airborne regional magnetic reprocessing and ground reconnaissance program are assisting recent geological re-interpretations and demonstrating the increased potential prospectivity of this essentially unexplored section of the Kalahari Copper Belt. The timing of the GWD1 AEM results allows the Company to initiate planned targeted field exploration in late February/early March 2018, when the current wet season is expected to reach its end.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.