Mt Carrington DFS on track, but Red Mountain could be the sleeper

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in White Rock Minerals (ASX:WRM) rallied 6.5% on Monday ahead of management’s update regarding the company’s progress with its Mt Carrington Definitive Feasibility Study (DFS) and an Environmental Impact Statement (EIS).

It should be noted that share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

As a backdrop, Mt Carrington has a JORC 2004 Resource containing 338,000 ounces of gold and 22.3 million ounces of silver. The upcoming completion of a new JORC 2012 resource will provide the company with models for the mining of gold and silver from five main deposits.

Management provided a brief in January regarding the overall goals of the upcoming studies, pointing to community consultation, the preparation and submission of a preliminary environmental assessment, a geological review of the resource and a detailed review and commencement of the metallurgical test work needed to lockdown the preferred plant design.

On Tuesday morning WRM’s Managing Director, Matt Gill wrapped a little more detail around the process in saying that he wants to confirm with greater accuracy and confidence that the technical aspects of the development are right, while also providing baseline technical plans for the environmental and government processes that will follow.

With regard to baseline studies, Gill is mainly referring to groundwater management, terrestrial ecology, ore haulage and ore and waste rock placement. WRM will also be generating a detailed social impact assessment strategy.

Red Mountain emerges as potential share price catalyst

While the Mt Carrington project is on the verge of meeting some important milestones, WRM’s Red Mountain project located in Alaska could be a surprise packet. The company is in the process of producing the first JORC 2012 compliant resource on the existing two deposits which are located 100 kilometres south of Fairbanks in the Bonniefield mining District.

WRM has 224 mining claims over an area of 143 square kilometres, much of which contains polymetallic VMS mineralisation, rich in zinc, silver and lead. Previous exploration has defined mineralisation at two main prospects, Dry Creek and West Tundra Flats.

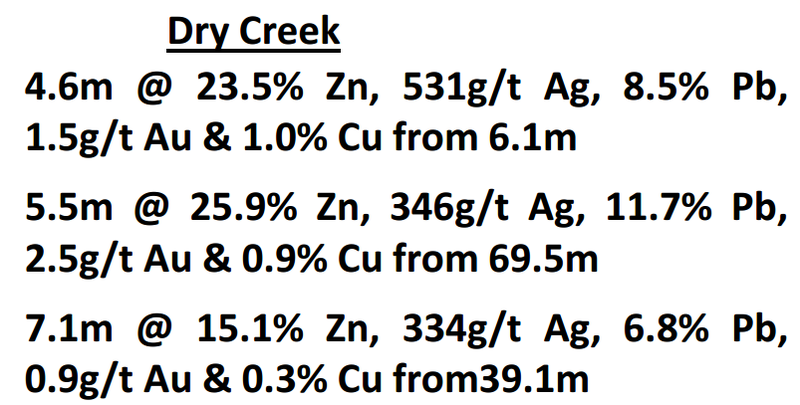

Historical exploration has returned some impressive results from both prospects. These are the results from some of the drill holes at Dry Creek.

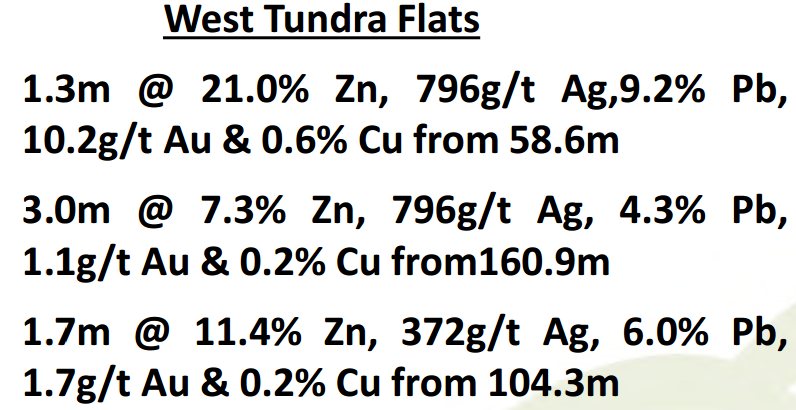

West Tundra also featured some strong zinc grades, but there were decidedly higher silver grades from that prospect.

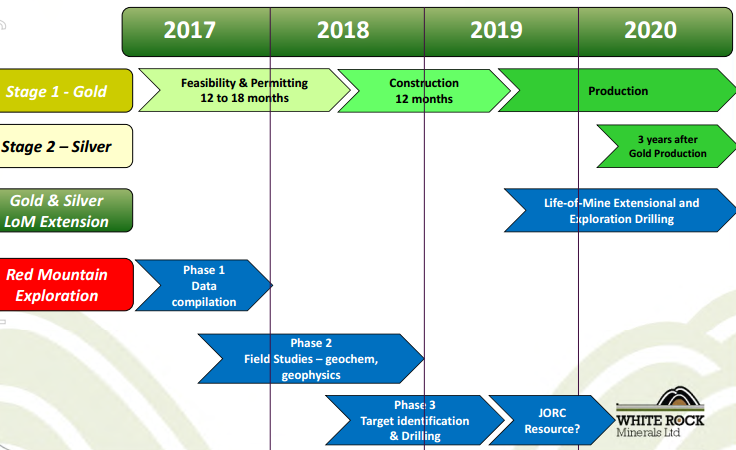

With both the Mt Carrington and Red Mountain projects being examined and potentially developed in tandem, management has provided the following indicative timeline.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.