Mozambi Resources moves on graphite in Mozambique

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

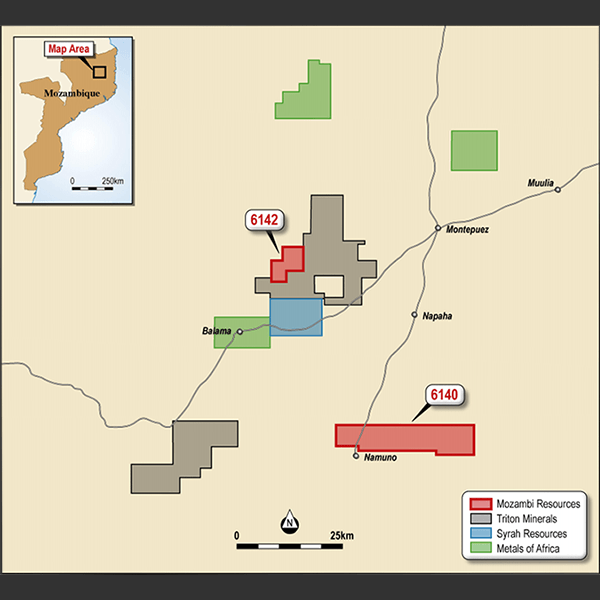

Mozambi Resources (ASX:MOZ) has signed an option to acquire two graphite licenses in the prolific Cabo Delgado region in Mozambique.

One of these licenses, 6142L, adjoins Triton Minerals’ (ASX:TON) Nicanda Hill graphite deposit, as well as lying just 5 kilometres from Syrah Resource’s (ASX:SYR) Balama deposit.

The Mozambique Mines Ministry is expected to grant these licenses in the coming weeks.

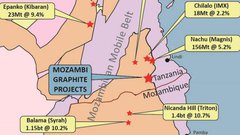

Triton’s Nicanda Hill deposit contains 1.45 billion tonnes at 10.7% graphitic carbon and 0.27% vanadium, whilst Syrah’s Balama holds 1.15 billion tonnes at 10.2% graphitic carbon and 0.23% vanadium.

MOZ will pay US$50,000 upon acquiring the option, and US$50,000 plus 15 million shares upon execution.

Performance based payments are 15 million shares upon reaching a JORC resource of 300 million tonnes at over 5% total graphitic carbon; and 15 million shares and US$250,000 upon reaching a JORC resource of 600 million tonnes at over 5% graphitic carbon.

In addition, a net smelter royalty of 3% will be paid on all minerals.

Project geology

MOZ’s push into Mozambique provides an opportunity to discover and develop a continuation of the prolific graphite mineralisation of the Balama and Nicanda Hill deposits.

Mozambi Resources are in solid company with Triton next door and Syrah 5km to the south

The underlying geology comprises high grade metamorphic rocks that stretch from southern Mozambique to the Red Sea in the north. There are widespread graphite occurrences throughout.

Several areas within this mobile belt are known to host large tonnage graphite deposits, usually with a high proportion of larger flake sizes. Larger flake sizes command a higher price in the graphite market, and are much sought after.

There has been limited fieldwork conducted on the tenements acquired to date, leaving room for potential new discoveries.

MOZ will commence fieldwork immediately after licenses are granted, possibly as early as this month. This will include trenching, rock chip sampling, mapping, and ground geophysical surveys.

The goal is to determine whether license 6142L contains a continuation of the stratigraphic hosting as seen at Balama and Nicanda Hill. Target definition at 6140L will occur concurrently.

Management comment

MOZ Executive Director Alan Armstrong added:

“We are very excited about the potential this area holds in an emerging basin for graphite and vanadium.

The board is extremely pleased with the quick turnaround time we have seen from the start of negotiations through to this point.

The smooth way in which we have been able to conduct this transaction is testament to the emerging mining industry in Mozambique.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.