Mozambi Completes Tenement Deal, Targets Early-October Drilling

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Mozambi Resources (ASX:MOZ) now has its foot on graphite tenements the size of a small country, and said drilling at its flagship Chiwata prospect would be underway in the first week of October.

MOZ picked up four more tenements in a previously announced deal struck with a local mining company – as previously reported on Finfeed.

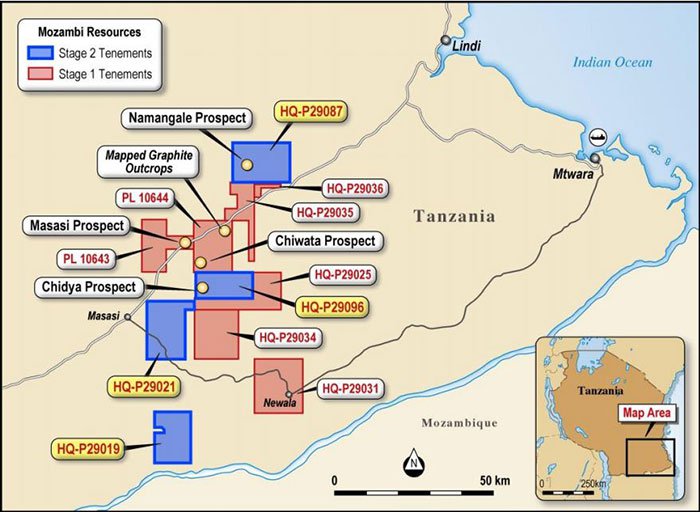

It told the market this morning that the addition of the four tenements to its portfolio brought MOZ’s total holdings up to 1995 sq.km over 11 tenements.

Crucially, the portfolio addition also doubles the amount of prospects MOZ has to explore for, with the Chidya and Namangale prospects joining the Chiwata and Masasi prospects.

Mapping, trenching, and rock chip sampling has been carried out at the incumbent prospects, which confirmed high-grade jumbo graphite flakes ahead of further drilling.

MOZ will carry out similar work on the new Chidya and Namangale prospects, focusing on known areas of outcropping. A ground electromagnetic survey will also be conducted on the new prospects in coming weeks.

Meanwhile, MOZ said preparations to drill the more advanced Chiwata prospect are gearing up with construction of an access track now complete.

Initial drilling will focus on a 4km strike, which was effectively quadrupled from 1km after a geological mapping and ongoing pitting program.

A ground EM survey is scheduled to start at Chiwata over the coming days ahead of drilling in the first week of October.

The project

The Chiwata prospect lies in the south east of Tanzania, which is quickly becoming a graphite hotspot in Africa.

A number of resource companies have declared resources nearby, including fellow ASX-listed company Magnis Resources (ASX:MNS), which has a project 60km to the north.

Map showing MOZ’s new tenements

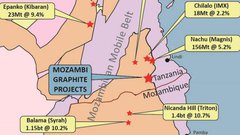

Graphite mineralisation in the province typically occurs in stratigraphic layers of graphitic schist within a package of high pressure metamorphic rocks which make up the Mozambique Mobile Belt.

This belt extends south into Mozambique, and is the belt being tapped by the likes of Syrah Resources (ASX:SYR) and Triton Minerals (ASX: TON), which have both identified graphite deposits of over 1 billion tonnes.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.