Mozambi begins the Hunt for customers

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Mozambi Resources (ASX:MOZ) has signalled it is moving into the commercialisation phase with the appointment of Stephen Hunt from Magnis Resources (ASX:MNS).

MOZ managed to snag the founding director of Magnis to become its chairman, as the company seeks to leverage Hunt’s experience in the graphite market to talk to end users.

It is thought Hunt has played a big role in several metals deals over the past 25 years, and has even gone as far as setting up his own minerals trading company with a strong Chinese focus.

He also spent time in London with BHP, selling minerals to European and Middle Eastern customers.

The appointment is a clear sign that MOZ is starting to talk more seriously to the graphite market about a potential offtake deal.

It is thought Hunt played a leading role in securing offtake deals for Magnis’ graphite, and given the relative proximity of the two companies’ projects, MOZ would be confident in being able to swing a deal.

“This is a major validation of our vision for the company, to be able to attract a director of the calibre of Mr Stephen Hunt,” MOZ managing director Alan Armstrong said.

To make way for Hunt, current chairman Aiden Wing will step down but remain at the company as a company secretary.

The buzz about Mozambi Resources (ASX:MOZ)

MOZ recently confirmed the presence of large to super-jumbo flake at its Namangale project in Tanzania.

Jumbo and Super Jumbo flakes are in demand from end users, as they are easier to process than finer materials.

It is thought that Magnis Resources’ (ASX: MNS) large to jumbo flake size was behind a raft of offtake deals struck with South Korean and Chinese companies including Sinosteel and Sinoma, despite having lower grades than contemporaries Triton Minerals (ASX: TON) and Syrah Resources (ASX:SYR). It has also recently struck an EPC and financing MOU with South Korean outfit Posco.

Grades for the samples have yet to be released, but MOZ is currently getting this tested ahead of a JORC resource estimate.

More on Namangale

The Namangale Prospect is contained in one of the areas picked up by MOZ as part of a deal struck with a local mining company back in September.

It picked up the prospect for an initial $104,000 in cash, with it also picking up three other tenements.

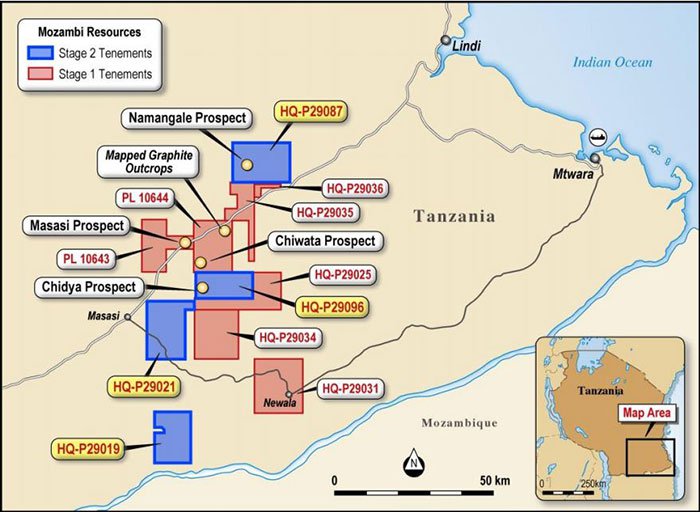

The Namangale Prospect is part of the broader Nachingwea Project in the south east of Tanzania, which is quickly becoming a graphite hotspot in Africa.

A number of resource companies have declared resources nearby, including fellow ASX-listed company Magnis Resources, which has a project 60km to the north.

Map showing MOZ’s tenements

MOZ’s project could be bigger in scale and covers more ground.

Graphite mineralisation in the province typically occurs in stratigraphic layers of graphitic schist within a package of high pressure metamorphic rocks which make up the Mozambique Mobile Belt.

This belt extends south into Mozambique, and is the belt being tapped by the likes of Syrah Resources (ASX:SYR) and Triton Minerals (ASX: TON), which have both identified graphite deposits of over 1 billion tonnes.

*An earlier version of this story incorrectly stated that MNS had an offtake agreement with Posco, rather than an EPC and financing MOU*

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.