MOZ finds abundant surface graphite at new Tanzania tenements

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Mozambi Resources (ASX:MOZ) has identified large surface zones of graphite schist, up to 180m wide and over a strike length of 1,000m, at its new Nachingwea Graphite Project in Tanzania.

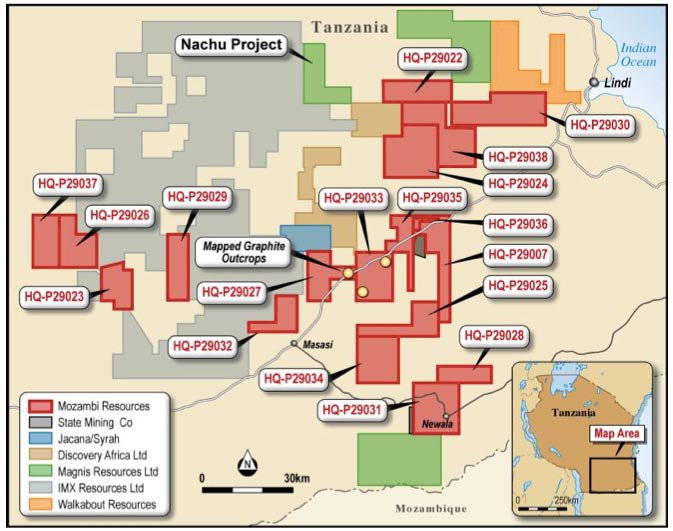

Nachingwea covers 18 highly prospective graphite tenements in South-Eastern Tanzania, and in May 2015 MOZ signed a binding Terms Sheet granting the company the option to acquire any and all of these tenements. Three of these tenements, which feature targets initially identified in recent recognisance mapping, have progressed with an offer to grant from the Tanzanian Ministry of Energy & Minerals.

This project complements MOZ’s existing graphite project in neighbouring Mozambique.

MOZ aims to develop these projects spanning two African countries simultaneously, then seek to link their exploration and production programmes to create a dominant source of graphite in East Africa.

Field work finds bulk graphite at surface

As part of its evaluation of Nachingwea, MOZ has begun field exploration of the area and is concentrating on two tenements initially – HQP-29033 and HQP-29027.

Teams in the field have identified multiple outcrops of surface graphite schist rock with some zones spanning up to 180m wide.

A strike length of 1,000m has now been identified, though trenching and rock chip sampling will be required to determine the grade of the rocks and identify high-grade graphite zones. Multiple areas of sub-cropping graphite schist have also been identified.

Visual estimates by ground teams put the graphite schists identified so far in the 5-10% graphitic carbon range, though follow up testing will be needed.

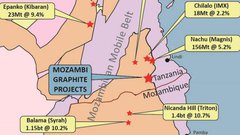

These results are encouraging for MOZ because the Nachingwea Project area lies within the Mozambique Mobile Belt. This area is a sequence of high-grade metamorphic sediments that host a number of world-class graphite deposits, including Syrah Resource’s Balama Project, which holds 1.15 billion tonnes at 10.2% graphitic carbon and 0.23% vanadium.

As field operations continue, MOZ is planning to begin rock chip sampling and trenching as soon as possible, to help identify and confirm which of the 18 licenses it has an option over will be progresses with.

Discarding less prospective licenses will help minimise holding costs and allow MOZ to pursue only the licenses with the best chances of having commercial quantities of graphite. Once the licenses are issued, MOZ will proceed with more detailed exploration, including drilling and mapping with a goals to work up JORC resources and develop mining plans.

Placement and right issue to support MOZ’s plans

To support its exploration and acquisition plans, MOZ has embarked on a drive to raise at least $1.3M through a share placement and rights offer.

The company has just completed a placement to raise $370,000 through the issue of 30,833,333 new fully paid ordinary shares at a price of $0.012c each with a one for two free attaching MOZO listed option with a strike price of $0.02c and expiring on the 31st of December 2015.

The placement was made to sophisticated and institutional investors of Alignment Capital Pty Ltd.

Meanwhile, MOZ is now well advanced in its drive to raise a further $925,000 before costs through a proposed non-renounceable 1 for 4 rights issue to eligible shareholders. Further details are expected to be released soon.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.