More streamlined Harvest One to offer MMJ improved returns

Published 29-JUN-2020 14:09 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

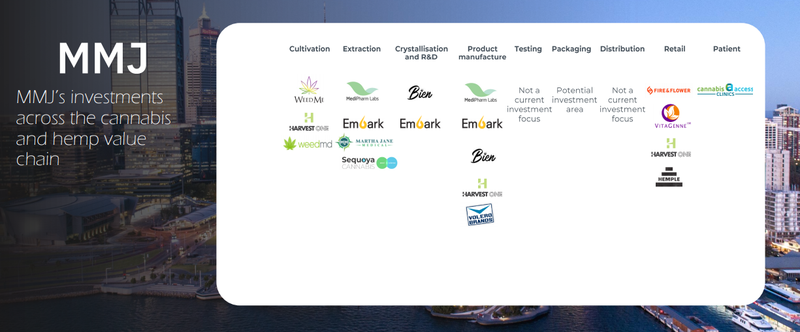

MMJ Group Holdings Limited (ASX: MMJ) has released some important news regarding one of its investee companies, Harvest One Cannabis Inc. (TSX-V: HVT; OTCQX: HRVOF).

As part of management’s previously announced strategic review, Harvest One has entered into a definitive agreement to sell its United Greeneries’ licensed cannabis cultivation and processing businesses located in Duncan, British Columbia to Costa Canna Production Limited Liability Partnership and 626875 B.C. Ltd. for a total cash consideration of C$8.2 million.

Under the terms of the sale, Harvest One will also effect a licence agreement with the purchasers, which will provide Costa LLP, through its licensed subsidiary, the right to use certain licensed intellectual property of Harvest One to produce and distribute Cannabis 2.0 products in Canada in exchange for a royalty to be paid to Harvest One and, in turn, provide Harvest One with distribution for Cannabis 2.0 products in Canada.

Underlining the benefits of this transaction, Harvest One chief executive Andrew Bayfield said, “The agreement to sell our Duncan Facility and its related operations represents a strategic step forward for Harvest One, further divesting from its capital intensive cultivation activities and firmly establishing ourselves as a cannabis-focused CPG company.”

“We will continue to focus on expanding our core brands of LivReliefTM, Dream WaterTM and Satipharm together with the commercialisation of Cannabis 2.0 product offerings in Canada.

“When complete, this transaction will significantly improve the company’s overall cost structure and will provide liquidity to strengthen our balance sheet.

‘’We are continuing to take necessary and decisive measures to streamline our operations, lower our cost structure and reduce our cash burn.

‘’I am confident we are on the right path and this transaction serves to further reinforce the company’s plan to become cash flow positive in fiscal 2021.”

MMJ to benefit from new business structure and improved sales

These are very much the ingredients to maximising shareholder value, making this transaction highly beneficial to MMJ Group which owns approximately 55.5 million ordinary shares in the group with a market value of approximately C$5 million.

MMJ had also negotiated a secured loan of C$2 million on which it was earning interest at a rate of 15% per annum, a facility which will be repaid from the settlement of the Duncan facility.

From a broader perspective, MMJ benefits from its diversification and management’s ability to target emerging opportunities in the cannabis sector where it has been able to both growing the value of its investment portfolio while locking in one-off gains through divestments that can optimise shareholder returns.

Harvest One also provided a promising trading update for the March quarter which included quarter-on-quarter revenue growth of 88% as it generated income of $3.3 million.

Underlying earnings are heading in the right direction with the loss of $2.4 million down substantially on the $5 million loss in the previous quarter.

Importantly, there was a 22% reduction in cash operating expenses, a significant development as the company moves towards growing its top line.

It is worth noting that MMJ is trading at a significant discount to its net tangible asset per share value which stood at 20.5 cents as at May 31, 2020.

As mentioned previously, the company has focused on investing in a broad range of businesses across the sector and the performance of these is reflected in the net tangible asset value.

Consequently, the company could be one for investors who wish to target the sector without being solely reliant on the performance of one particular company.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.