Metminco has quality suite of assets and cash for further development

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Having commenced diamond drilling at its Tesorito gold prospect in the Quinchia district of Colombia in June, Metminco (ASX:MNC | LON:MNC) looks to be progressing nicely.

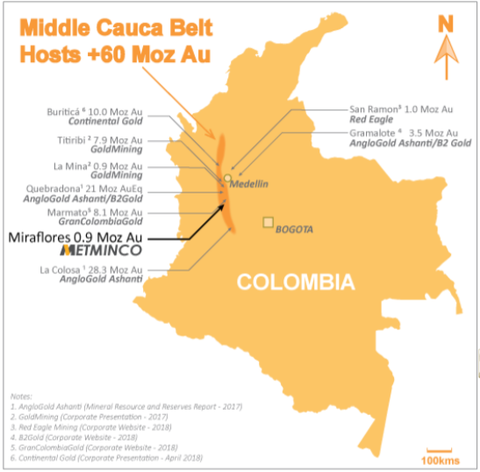

MNC has rights to several highly prospective exploration prospects and targets around Quinchia in Colombia's Cauca Belt.

This region is host to several large gold resources including AngloGold Ashanti’s 28.5 million ounce La Colosa deposit and Gran Colombia’s 8.6 million ounce Marmato deposit.

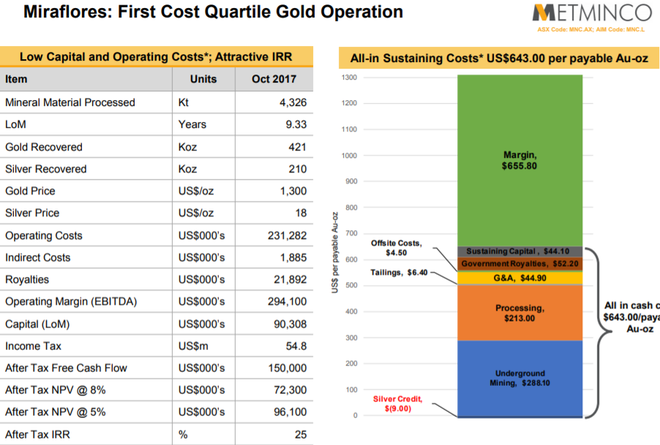

The company already has a project that has been the subject of a definitive feasibility study (DFS) which has determined that a 45,000 ounce per annum/9.5 year project could be undertaken.

Importantly, all in sustaining costs indicate that such a project would be positioned in the lowest quartile, leaving strong margins relative to the current gold price and resilience should weakness occur.

However the gold price is a moveable thing and interested investors should take all publicly available information into account before making an investment decision.

Drilling aims to expand known gold system

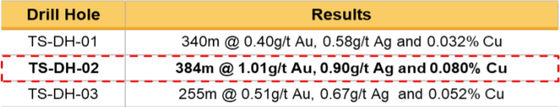

With regards to Tesorito, the 1500 metre exploration program is designed to confirm and expand the gold-copper porphyry style mineral system previously intersected by another operator.

This included one hole featuring 384 metres at 1.1 g/t gold from surface to end-of-hole.

Results from previous drilling are as follows.

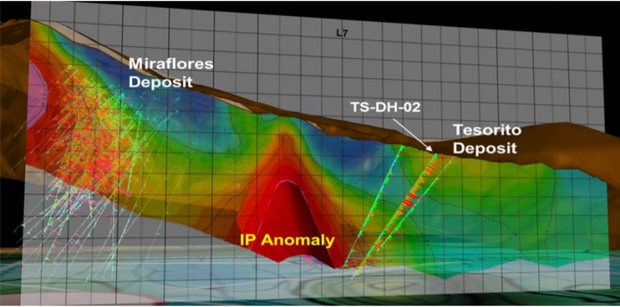

The exploration program will also test a previously undrilled geophysical anomaly located approximately 300 metres to the north-west of TS-DH-02 as indicated below.

Management believes there is the prospect of encountering increasing copper mineralisation at depth.

Assay results from the diamond drilling at Tesorito are expected in August 2018, and based on management’s assessment of the type of mineralisation and survey data, the results could bring the company under the microscope.

Tesorito largely underexplored

While the data available in relation to Tesorito was enough to attract Metminco’s interest, the area is largely underexplored.

Given that the broader Quinchia portfolio is in a district known for its high grade gold/silver systems, the company could possibly be onto another La Colosa -type deposit.

More specifically, the mines are located within the same structural trend as La Colosa and Marmato, being the mid-Cauca porphyry gold belt.

It is worth noting that this isn’t just a broad-based nearology play.

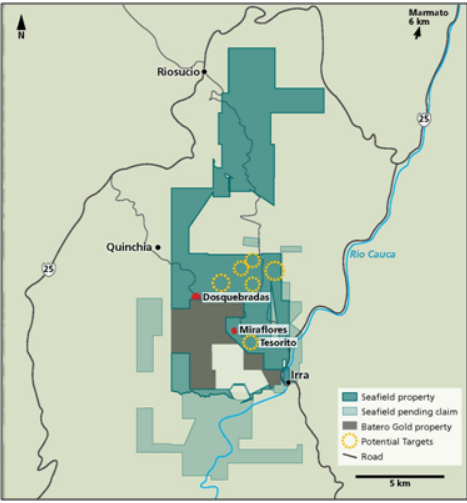

As indicated below, the Quinchia portfolio is only six kilometres south of Marmato.

Established mineral resource on acquisition

The background behind Metminco gaining ownership of the Quinchia portfolio is somewhat complex but interesting.

The company completed the purchase of Minera Seafiled SAS from RMB Australia Holdings Ltd on June 20, 2016.

Minera Seafield, now Miraflores Compania Minera SAS (MCM) owns 100% of the Quinchia Gold Project where a mineral resource of 2.8 million ounces of gold had been estimated.

The Quinchia Portfolio covers about 6000 hectares of granted concessions and an additional 3800 hectares of pending applications.

As indicated above, several deposits and exploration targets have been identified including Miraflores, Dosquebradas and Tesorito.

Dosquebradas has an inferred resource of 920,000 ounces at 0.5 g/t gold, but Miraflores has had the most work done in terms of crunching the numbers to bring it into production.

Miraflores shows promise in terms of increasing resource

A feasibility study completed in October 2017 established a proven and probable reserve estimate at Miraflores of 4.32 million tonnes at 3.3 g/t gold for 457,000 ounces of gold.

The resource estimate is 9.27 million tonnes measured and indicated at 2.8 g/t gold and 2.8 g/t silver for 840,000 ounces of gold.

A DFS completed in late 2017 determined that a 45,000 ounce per annum operation could be established with a mine life of 9.5 years.

All in sustaining cost estimates of US$643 per ounce leave a healthy margin of about US$630 per ounce based on the current gold price.

This equates to about $850 per ounce in Australian currency terms.

Option agreement with AngloGold Ashanti is a bonus

Metminco also has an option over Chuscal, a large undrilled 0.5 g/t gold geochemical anomaly where artisanal mining has demonstrated highly encouraging channel sample grades.

It is only 1.5 kilometres south of Tesarito, and management is negotiating exercise of the option with AngloGold Ashanti.

The $3.4 billion capped AngloGold Ashanti, the US$20.6 billion-capped Newmont Mining Corp (NYSE:NEM), and US$3.6 billion IAMGOLD (TSX:IMG) each have operations in Colombia which you can read more about in the Next Small Cap article: Cashed Up Micro-Cap Hunts for Gold in Colombia.

Cashed up to embark on exploration campaign

Metminco raised about $5.6 million before costs in April leaving the group with circa $3 million to fund its exploration initiatives.

This will provide the funds required to investigate other highly prospective targets.

Given that 30 per cent of the company’s market capitalisation is accounted for in cash, Metminco could be considered as due for a rerating.

It isn’t difficult to see $6 million in value in the company’s assets, particularly given the after-tax net present value (NPV) of US$72 million attributed to Miraflores in the DFS.

Although the company does remain a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

The completion of an environmental impact assessment and permitting will continue throughout 2018, and consideration will be given regarding higher grade opportunities that would enhance the NPV.

The company’s balance sheet could be further strengthened by the divestment of non-core projects in Chile.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.