Meteoric stakes additional cobalt ground at Mulligan

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Meteoric Resources NL (ASX:MEI) today announced the expansion of its Mulligan cobalt landholding via staking an additional 90 claims (13.7 square kilometres) for surrounding tenements.

The additional cobalt-prospective ground is approximately 5km east of the Mulligan Cobalt project situated in Ontario’s Cobalt Embayment. The area is renowned for its historic production, including over 28 million tonnes cobalt and 720 million ounces silver.

MEI is hoping there is considerable potential to be unlocked in the nearby land, with similar trending structures that hosted historical high-grade cobalt production at Mulligan, returning grades up to an impressive 10% cobalt.

It should be noted, however, that this is a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

The newly gained ground will become part of the Mulligan East Cobalt Project, comprising 19 claims in total across 1371 hectares or 13.7 square kilometres.

The project sits just 50 kilometres north of the historic cobalt mining centre of Cobalt, and circa 5 kilometres east of the existing Mulligan claims — where exploration efforts are targeted at high-grade silver-cobalt vein-style mineralisation similar to that mined at Cobalt itself.

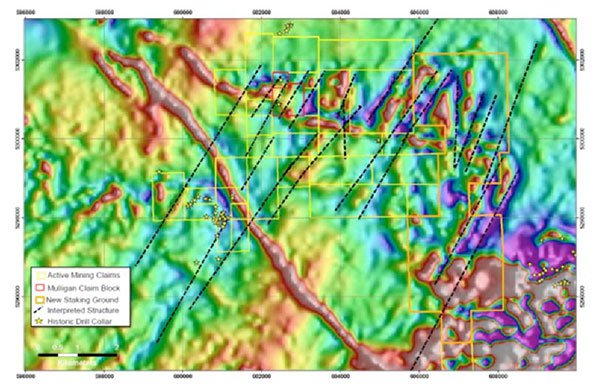

The below image of the Mulligan and Mulligan East Cobalt project shows the NE trending magnetic-highs claims are associating with Nipissing Diabase intruding into Huronian sediments.

Image source: Meteoric Resources.

Historical assays completed at nearby sites have demonstrated impressive grades of up to 4.5% cobalt, and 87g/t silver within mineralisation at Foster Marshall.

The company expects rock-chip and soil samples assays from the Iron Mask & Mulligan projects to be released in the coming weeks.

A closer look at the geology

According to MEI’s experts, the main rocks at Cobalt that host cobalt-silver vein mineralisation are Coleman Member sediments of the Huronian Supergroup, Nipissing Diabase sills and volcanic Archaean basement rocks.

In the company’s own words, the mineralised veins of the Cobalt Embayment are interpreted as a shallow, peripheral component of large-scale hydrothermal systems where fluid flow was focused along both the regional unconformity between basement rocks and overlying sediments and reactivated faults that offset the unconformity.

MEI’s announcement then went into further technical detail regarding how the project’s style of deposit came to be: ‘The magnetic data correlates well to outcrops of Nipissing Diabase and indicates a dominant NE-trending control.

At the Cobalt mining centre, regional NE-trending structures are prevalent. It is most likely these structures were reactivated during and post deposition of the sediments and Nipissing Diabase, with mineralised veins and vein sets forming in areas of dilation.’

In terms of the prospectivity of the Mulligan Project, large outcrop hills have been identified via satellite imagery, and can be interpreted as ‘Nipissing Diabase sills’ preferentially weathering as topographic highs.

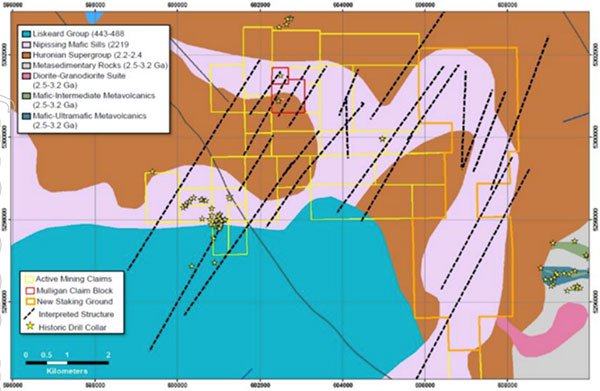

This and further exploration data also point to the promising possibility of distribution of both the key Nipissing Diabase and Huronian Supergroup sediments (of the Cobalt Embayment) within the staked area at Mulligan East, as indicated in the figure below:

Source: Meteoric Resources.

This is all promising news for the A$30 million-capped MEI as it looks to shore up what it’s got at Mulligan, while also expanding the project as part of a longer-term exploration agenda.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.