Meteoric Resources outlines exploration plans for polymetallic assets in Canada

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

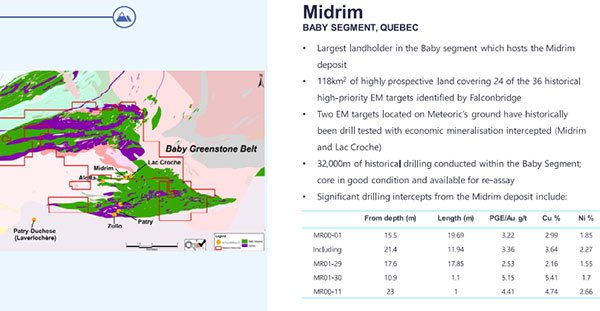

Following a preliminary site visit and field study of the project area by the company’s exploration manager, Max Nind indicated that the preliminary metallurgical study of historical drill cores from the Midrim prospect was progressing well.

In order to conduct this study, three holes were selected, with core samples cut and composited to make up a 50 kilogram sample. The results should assist in identifying the

appropriate process for extraction and the potential recovery of Cu-Ni-Co-PGE metals at the Midrim project. Results of the preliminary metallurgical study are expected in Q4 2017.

As part of the validation process, the re-assaying of a representative sample of nine historical drill cores, including geological units that have previously not been assayed is being undertaken to confirm historical assay results, as well as assisting in the identification of potential new zones of mineralisation.

The metallurgical test work will develop a suitable processing flowsheet and design to support a substantially larger bulk sample mining study. This later study will identify the viability of extracting a suitably sized zone of shallow mineralisation from within the existing historical drilling area for trial processing. Results of the bulk sample study are also expected in the fourth quarter of 2017.

Meteoric has multiple assets in play in highly prospective regions

Management highlighted that MEI has the unique opportunity to concurrently explore multiple highly prospective properties through its close relationship with Orix Geoscience and their team of highly competent and respected technical personnel.

This should allow the company to rapidly advance its projects through a fully funded initial work program being conducted this quarter. In expressing early signs of confidence in MEI’s outlook, Nind said, “I am very encouraged by my initial visit and review of the extensive historical database and believe the potential to make significant primary cobalt and copper-nickel-cobalt-PGE discoveries on the three project areas has never been greater.”

It should be noted here however, that MEI is an early stage company and investors should seek professional financial advice if considering this stock for their portfolio.

MEI is also in the process of considering appropriate programs to be conducted at both the Iron Mask and Mulligan projects. The former is located in Ontario, Canada and is in close proximity to an area that has yielded historical production of cobalt and silver.

The Mulligan project is also located in Ontario, and grab samples have yielded up to 12.6 per cent cobalt and 39.7 grams per tonne silver. The deposit contains six parallel polymetallic veins, 16 metres apart across a strike length of 150 metres.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.