Meteoric Resources to acquire People Post

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Meteoric Resources (ASX:MEI) has set the record straight with regards to its future.

With speculation mounting as to what the junior explorer would announce after going into a Trading Halt last week, MEI has revealed that it intends to acquire People Post in an all-share deal. People Post will be acquired in exchange for 370 million MEI shares, with an indicative value of A$8.1 million at the current market price of $0.022 per share.

In a keenly awaited market announcement, MEI says it has entered into a binding Heads of Agreement to acquire 100% of People’s Post in exchange for MEI shares and pre-agreed performance milestones. MEI has also paid a $250,000 exclusivity fee to People Post.

MEI has agreed to issue a further 125,000,000 fully paid ordinary shares if it achieves A$16.67m or more in revenue within the first 24 months, a further 125,000,000 shares if it registers A$33.44m within 36 months and a further 160,000,000 shares on achievement of A$3m EBITDA within 48 months.

In addition to the deal and performance milestones, MEI must also conduct a A$3 million capital raising as part of the ASX re-listing process.

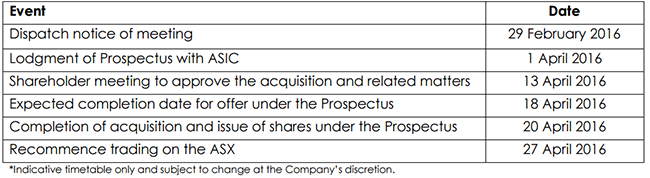

The two parties have now entered a 30 day due diligence period within which MEI intends to conduct “due diligence enquiries and investigations in relation to all aspects of People Post”. Subject to due diligence being completed and MEI Board approval, MEI will complete the acquisition by the end of April with the newly listed entity recommencing trading around 27 April 2016.

Delivering the Post in a sharing economy

People Post is a courier company with a tech differentiation that draws comparisons with Uber and Airbnb – two of the world’ most successful tech start-ups that focus on users sharing their goods and services.

Co-founded by Wayne Wang, the company specialises in coupling the principles of a ‘sharing economy’ with the business of delivering parcels. Its proprietary technology connects businesses and consumers with freelance couriers across Australia and Europe.

Drawing comparisons with Uber, a company that is utilising the sharing economy to shake up taxi journeys; People Post is a delivery solution aiming to disrupt the courier industry currently prohibited by industry rules, pricing and schedules.

According to its founders, People Post was “born out of a frustration that we experienced every time we used a courier. Sending a small parcel was expensive, took unnecessarily long to book, and led to hours of waiting time until the parcel was picked up.

“The answer, People Post, is not only cheaper, faster, and easier for those sending parcels, but is also a great way for people to earn income as a runner.”

One of the biggest attractions for individuals and corporate clients already using People Post is that the service is entirely user dependent which means it is available 24 hours a day, 7 days a week, 365 days a year. The company boasts of completing Christmas Day deliveries and other such holiday periods because under its business model, working hours are set by its users.

Other alluring features for users include flexible pricing delivered as part of a competitive bidding system, shortened delivery cycles, secure payment options, live GPS tracking, push notifications and a ratings system to rank its runners (couriers) to improve customer satisfaction.

The technology powering People Post allows it go above and beyond what traditional couriers can offer and therefore carve out a competitive edge against other courier companies.

“We are making courier services more available, affordable and reliable,” says co-founder Wayne Wang, and the MEI deal “allows us to aggressively scale up our expansion plans in both Australia and Asia,” he added.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.