Merlin waves the magic wand at diamond mine

Published 31-JUL-2018 12:46 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Australian diamond mining company Merlin Diamonds Ltd (ASX:MED) recently informed the market that the installation of a new scrubber would assist in doubling processing capacity at the Merlin Diamond Mine.

Processing will increase from the 50 tonnes per hour to 100 tonnes per hour, thus doubling the production of diamonds. The new scrubber, screen and conveyor belts are being prepared for shipping and are expected to arrive at Merlin in late August.

The scrubber will also significantly reduce the recirculation of oversize material and give Merlin the ability to feed damp ore directly from the pit.

Providing further efficiencies, Merlin has purchased a jaw crusher which will be introduced into the processing circuit to treat the trommel oversize material.

A Dense Medium Separation (DMS) circuit has also been ordered from South Africa, and once installed, capacity will increase upwards of 150 tonnes per hour.

However it is an early stage of this company’s development and if considering this stock for your portfolio you should take all public information into account and seek professional financial advice.

Good news on all fronts at Merlin

Not only is the processing plant upgrade a substantial step in terms of the company’s long-term production profile, but there have also been other recent developments that are material in the company’s transition to a major producer.

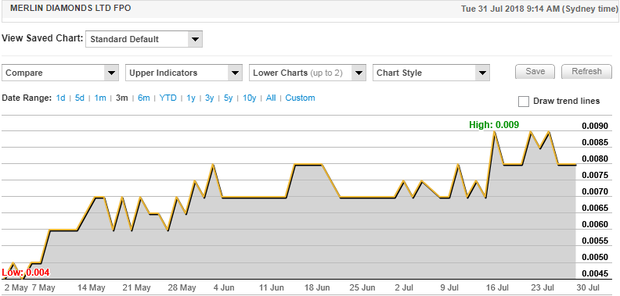

Current events haven’t been lost on the market with the company’s shares doubling in the last three months.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

A green light from the Northern Territory Government Department of Primary Industry and Resources in reviewing Merlin’s amended Mine Management Plan (“MMP”) was a significant development, allowing the company to commence mining at all five pits being, Excalibur, Gwain, Ywain, Ector and Kaye.

There has also been promising news on the production front with the company recovering 32 pink diamonds totalling 6.6 carats.

Management is encouraged by the discovery of the highly valued pink diamonds at Merlin as it is a good indicator that more significant discoveries will be made as mining commences in the aforementioned five pits.

Broker sees substantial upside

Although the company’s shares have performed strongly in the last three months, analysts at Empire Capital Partners believe the share price momentum can be sustained as production increases and the company delivers underlying earnings of $61.4 million in fiscal 2019. Analyst, Peter Bird said, “Merlin presents as a speculative buy to investors.

“With a market cap of just $25.8M, early investors could be buying into an overlooked resource that has significant potential to return and potentially surpass its previous performance.

“The recent commencement of full-scale mining activities for Merlin will be a major catalyst for a share price increase, along with a steady news flow concerning diamond production and major finds.”

He has a speculative buy recommendation on the stock with a 12 month price target of 6.7 cents, implying circa 700 per cent upside.

It should be noted that broker projections and price targets are only estimates and may not be met. Those considering this stock should seek independent financial advice.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.