MEI stakes additional cobalt project in Canada

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

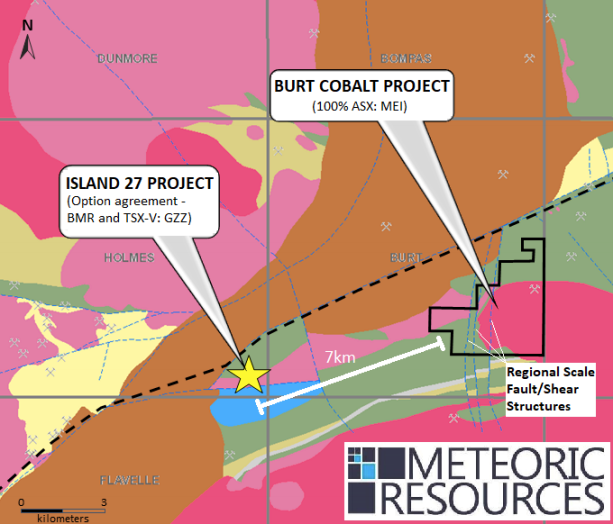

Canadian explorer, Meteoric Resources NL (ASX:MEI) today announced it has staked the Burt Cobalt Project in Ontario, Canada.

Comprising 9.34 square kilometres of highly prospective primary cobalt ground, the Burt Project is situated seven kilometres directly along strike from Battery Minerals Resources’ and Golden Valley Mines’ (TSX-V:GZZ) ‘Island 27 Project’.

Source: Meteoric Resources

The Burt Project hosts three major, north-south trending faults identified as being the key hosts of primary cobalt mineralisation throughout the district. These faults, which cross-cut the same andesite unit hosting the cobalt mineralisation at Island 27, represent over 5.7 kilometres of strike length potential for high-grade primary cobalt mineralisation.

These cobalt fertile structures will be the focus for MEI’s exploration program of mapping, geochemistry, geophysics and drilling, which is planned for the second quarter of the year.

While things look promising for MEI, it is early stages here and investors should seek professional financial advice if considering this stock for their portfolio.

Potential for primary cobalt mineralisation here has been identified by Orix Geoscience’s proprietary asset identification software, and confirmed by a recent review completed by Tony Cormack.

The cobalt-silver-nickel-gold anomalies generated at the Island 27 Project were identified through an induced polarisation geophysical survey (IP) and diamond core drilling in 2013, which intercepted high grade cobalt mineralisation in a breccia associated with the regional fault zone.

This brecciated fault zone included a sulphide-rich zone returning high-grade cobalt assays in association with strongly elevated silver, nickel and gold. The weighted average of the four-metre downhole intercept is 4.18 per cent cobalt, 12.1 grams per tonne of silver, 0.38 per cent nickel and 0.098 per cent gold.

MEI managing director, Andrew Tunks said: “Leveraging off our strong relationship with Orix (a leading Canadian geology consulting group), allowing us access to their proprietary asset identification system, the Meteoric team has moved quickly to stake highly prospective primary cobalt and nickel-copper-platinum ground in Canada.

“The Burt Cobalt Project fits our exploration model and adds value to our carefully selected portfolio. Meteoric is actively targeting further copper-cobalt-nickel-platinum opportunities both in Canada and across the globe.

“The company is continuing to refine its exploration strategy, with a strong focus towards expenditure in the ground and an active exploration program over the coming months. We now have the right team in place, we are fully funded, and will hit the ground hard, aiming to add significant value to our exciting projects,” he said.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.