Major copper-gold acquisition could transform Hot Chili into leading ASX developer

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Hot Chili (ASX:HCH) has revealed the details of a potentially game-changing transaction that it’s undertaking with well-regarded Chilean mining group, SCM Carola.

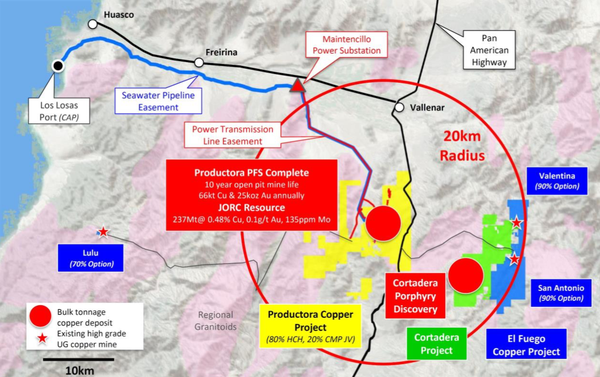

Following 18 months of high-level discussions, Hot Chili has executed a binding memorandum of understanding (MoU) for an option to acquire a 100% interest in Carola’s large landholding, which adjoins HCH’s Productora and El Fuego copper projects in Chile.

Most importantly, Carola’s Vallenar landholdings include a major copper-gold porphyry discovery, named Cortadera, which has never previously been publicly released, and which lies 14km directly southeast of Productora.

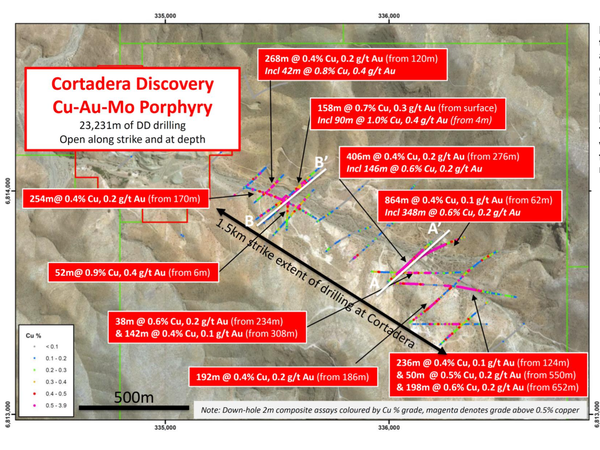

The hitherto unreleased drill results from the Cortadera discovery include numerous significant drilling intersections from over 23,000m of diamond drilling completed to date, including:

- 90m grading 1.0% copper and 0.4g/t gold from 4m down-hole depth

- 52m grading 0.9% copper and 0.4g/t gold from 6m down-hole depth

- 864m grading 0.4% copper and 0.1g/t gold from 62m down-hole depth (including 348m grading 0.6% copper and 0.2g/t gold)

- 268m grading 0.4% copper and 0.2g/t gold from 120m down-hole depth (including 42m grading 0.8% copper and 0.4g/t gold)

- 406m grading 0.4%copper and 0.2g/t gold from 276m down-hole depth (including 146m grading 0.6% copper and 0.2g/t gold)

- 198m grading 0.6% copper and 0.2g/t gold from 652m down-hole depth

This, in turn, is one of the most significant set of copper-gold porphyry discovery drill results since the discovery of SolGold’s (TSX/LSE:SOLG) Cascabel deposit in Ecuador.

Successful completion of the transaction could lay a foundation for the creation of a new, globally significant copper development centred around two bulk tonnage copper-gold deposits: Productora (HCH 80%, JV partner CMP 20%) and Cortadera (Carola).

It would also provide the immediate critical mass required to develop a new large-scale, long-life copper mine, transforming Hot Chili into a premium ASX-listed copper developer.

The Cortadera discovery remains largely open and has demonstrated potential to host a larger resource base than Productora, currently 1.5Mt copper and 1Moz gold.

Drilling is set to kick off following the expected execution of a formal option agreement within the coming months.

Hot Chili managing director, Christian Easterday, said the proposed transaction is pivotal for the company, and follows a similar move by neighbours Teck and Barrick at their Nueva Unión copper project in Chile (combining the Relincho and El Morro deposits to form a more robust consolidated copper development).

“We are very pleased to have agreed the key commercial terms for an option to acquire 100% of Cortadera for incorporation into a single larger development with Productora, taking advantage of planned central processing facilities,” Easterday said.

“Cortadera looks likely to provide the immediate critical mass required to develop a new large-scale, long-life, coastal copper mining centre which leverages off existing infrastructure advantages already secured with Hot Chili’s joint venture partner at Productora, Chilean mining major Compania Minera Pacifica (CMP).”

“Along with the recent consolidation of other high-grade satellite copper mines in the area, we have now assembled agreements to consolidate a truly world-class regional copper camp.

“The new consolidated development has the potential to place within the production scale range of the top 30 largest operating copper mines globally.

“We believe that combining Cortadera and Productora makes a lot of sense.

“Hot Chili has entered into project-level, strategic funding discussions with key stakeholders in relation to the proposed Carola transaction,” Easterday noted.

For the specifics of the MoU key terms, see the announcement released today.

More on the Cortadera copper-gold porphyry discovery

As mentioned, Cortadera lies 14km directly southeast of Hot Chili’s flagship Productora copper project, located at low altitude along the Chilean coastal range, 700km north of Santiago.

A total of 39 diamond drill holes (HQ core) for 23,231m have been completed across a strike extent of approximately 2km at Cortadera since the copper-gold porphyry deposit was first drill tested and discovered in January 2011.

The deposit comprises a cluster of outcropping tonalitic porphyry bodies, which have been vertically intruded along a regionally significant NW-trending fault corridor, through a shallowly dipping sequence of intercalated felsic volcaniclastics and sediments.

Multiple phases of tonalitic porphyries have been mapped and recognised in diamond core including an early, intermediate and late phase of intrusion.

Drilling across the porphyries recorded strong intersections of copper, gold, molybdenum +/- silver from surface to depths of approximately 900m vertical. Copper and gold show a strong correlation from assay results throughout the deposit with molybdenum generally increasing in grade at depth.

The deposit is oxidised to approximately 70m vertical depth, with transitional oxide/sulphide mineralisation extending to approximately 100m vertical depth from surface.

Copper is mainly associated with malachite and chalcocite within the oxide zone and chalcopyrite within the sulphide zone of the deposit. Investigation of detailed logging and surface mapping has demonstrated a close association of vein density and copper grade distribution.

Higher copper grades within the oxide zone are associated with chalcocite, while higher copper grades within the sulphide zone have been related to high molybdenum grades, potentially representing a higher grade phase of mineralisation.

Importantly, the deposit remains open at depth and along strike with several wide, higher grade drilling intersections not closed-off.

Review of data collection procedures, QA/QC assay protocols and the retention of half core from drilling already completed, have provided confidence in the quality of diamond drilling and sampling undertaken to date.

While no compliant resource has been estimated at Cortadera, the company considers that minimal work would be required to establish an initial and significant JORC-compliant copper-gold-molybdenum mineral resource estimate from surface.

HCH also considers that the Cortadera deposit has demonstrated potential to host a larger resource base than Productora, currently 1.5Mt copper & 1Moz gold.

The binding MoU provides the basis for the definition, potential acquisition and incorporation of Cortadera into a combined development plan with Productora and Hot Chili’s growing stable of high grade satellite copper mines.

An estimated US$15 million of drilling and exploration activities have already been undertaken across Cortadera since its discovery. Retained half core and definition of three porphyry centres will allow HCH to move quickly and at low cost towards a dramatic re-shaping of the company’s open pit resource and reserve base.

The potential combined development is likely to be one of the few low capital intensity, high- margin, large copper developments available globally.

Moreover, given the shortage of new large copper supply from low-risk, stable mining jurisdictions, Hot Chili is now well-positioned to establish itself as a premier ASX-listed copper developer.

Preparation of a formal option agreement is well-advanced; Hot Chili expects to ink the agreement and commence drilling across key areas of the Cortadera discovery within the coming months.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.