Lithium focused MPJ off to a flyer in the Pilbara

Published 25-FEB-2016 14:07 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

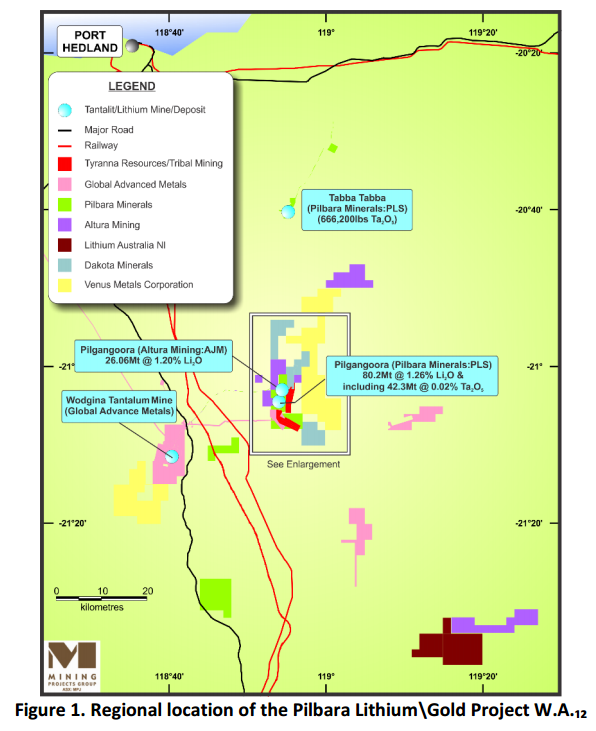

Hot on the heels of acquiring a prospective lithium asset in Australia’s Pilbara region, Mining Projects Group (ASX:MPJ) has just received its first exploration results in the form of an airborne magnetic survey.

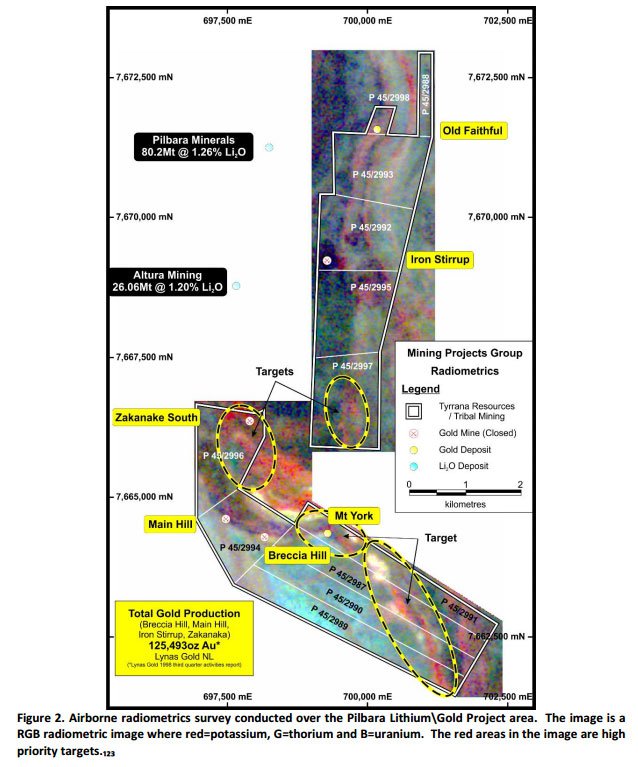

MPJ acquired the Pilbara Lithium/Gold Project from Tyranna Resources (ASX:TYX) last month (previously named ‘Lynas Find Assets’), and has moved quickly to draft in MAGSPEC Airborne Surveys Pty Ltd to undertake an ultra-detailed combined airborne magnetic/radiometric survey over the entire Project tenement package. MPJ hopes that its initial exploration on the new Project will help prioritise the most prospective target areas for future exploration.

According to MPJ, “the airborne survey is completed and high priority targets [have been] identified. MPJ completed over 1,410 line kilometres of ultra-detailed surveying with the results made public earlier today.

Preliminary results suggest MPJ’s Pilbara project area has high priority potassium-rich targets littered across it – often an early indicator for high grade lithium and gold deposits.

The airborne survey was conducted with “25m line spacing and 25m sensory height” says MPJ, and adding that “preliminary data is of extremely high quality”. The new magnetic data will now enable MPJ to conduct a detailed assessment of the structural controls of the known gold bearing trends in the project, and importantly, the identification of previously unrecognised/untested targets.

Pilbara in depth

The Pilbara Lithium/Gold Project adjoins Pilbara Minerals’ (ASX:PLS) Pilgangoora lithium-tantalum project totalling 52.2Mt @ 1.3% Li2O and 32.9Mt @ 0.0022% Ta2O5. Also adjacent, is Altura Minings’ (ASX:AJM) lithium project totalling 26Mt @ 1.2% Li2O.

In acquiring the Pilbara Lithium/Gold Project, MPJ hopes to emulate resource definitions achieved by its local neighbours thereby diversifying its asset portfolio and gaining exposure to lithium – a commodity-downturn resistant metal currently undergoing growing demand on the back of surging sales of lithium-ion batteries.

There is also a distinct possibility of finding significant gold deposits at the site, after recent exploration data was carefully reviewed.

Final airborne surveying data will be received in the coming weeks after a detailed analysis by geophysical consultants Terra Resources Pty Ltd.

In response to today’s airborne survey results, MPJ Managing Director Joshua Wellisch said, “Investing in a survey of this quality so quickly is a great example of MPJ’s core philosophy of acquiring the very best geoscientific data sets that we can in order to ensure that every stage of our project evaluation process is underpinned by technical excellence”.

“We are extremely excited that the preliminary data has highlighted a range of very high priority targets, in a region with such a wealth of mineralisation” he added.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.