Lithium bound Ardiden looks to test its mettle

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Ardiden Limited (ASX:ADV), the junior graphite explorer who just last month ventured into the lithium space, has announced it will commence diamond core drilling on its Seymour Lake Project immediately.

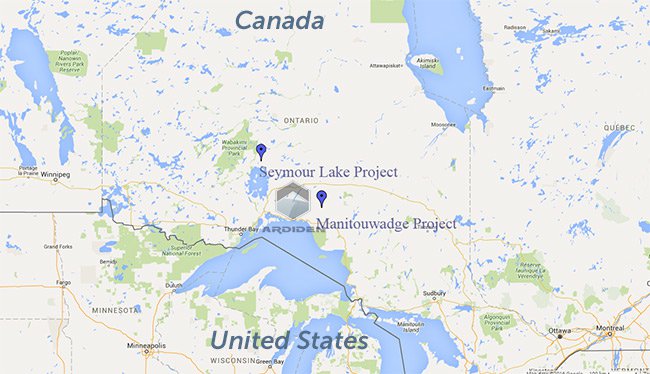

The Seymour Lake Project is located near the town of Armstrong in Ontario, less than 4 hours from a key infrastructure hub at Thunder Bay and within 100km from the US border. The lithium-beryllium-tantalum project comprises five patented mining claims covering an area of 912 hectares.

In an ASX market update, ADV says it received drilling approvals from local Canadian authorities and has already selected a local drilling contractor to commence “in the coming week”.

ADV has planned diamond core drilling as part of an initial due diligence program to confirm encouraging historical lithium drill results at Seymour Lake. Significant historical lithium intersections include 2.21% Li2O over 5.70m, 2.39% Li2O over 9.20m and 2.081% Li2O over 16.90m.

Additionally, ADV hopes to generate cash flow from sales of other minerals found alongside lithium exploration. Tantalum and beryllium grades of up to 1180ppm (Ta2O5) and 1270ppm (BeO) respectively, were intersected in the past, which could provide ADV with by-product credits currently worth around US$500 per kg.

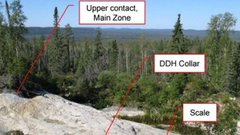

ADV says that the upcoming drill program “will also help to define the boundaries of the main outcropping spodumene-bearing pegmatite structures which host the lithium mineralisation at the Project”.

With over 4,000m of historical diamond drilling, the Seymour Lake Project hosts lithium-beryllium-tantalum mineralisation within the Caribou Lake Greenstone Belt, 230km north-north-east of the mining centre of Thunder Bay in Ontario.

The project has strong potential to produce a high quality lithium product to service growing North American demand and export markets.

Combined with the historical data, the results of the upcoming drilling and exploration program will enable Ardiden to make a detailed assessment about the potential of the Seymour Lake Lithium Project before considering whether to exercise its option to purchase the project.

If ADV finds sufficient commercial potential at Seymour Lake, it will likely pay around C$1,000,000 to claim full ownership.

Seymour Lake acquisition terms

- ADV has paid a C$75,000 exclusivity payment to commence a 150-day option and due diligence period

- ADV to pay a further C$75,000 in cash and C$250,000 in ADV shares at the end of due diligence

- If ADV wants to pursue the project post-option period, the company must pay C$25,000 per quarter

- A further C$250,000 in ADV shares to be paid at the completion of the option period for a total compensation of C$1,000,000 for 100% ownership of Seymour Lake

- ADV withholds the right to accelerate or withdraw from the option at any time.

The reasoning behind venturing in lithium exploration is because ADV is aiming to supply the growing market for lithium-ion batteries that require large amounts of both graphite and lithium. With its Manitouwadge graphite project progressing on schedule, ADV hopes to progress a lithium project in tandem, therefore capturing the entire value chain in supplying battery manufacturers.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.