Latin Resources acquisition provides opportunity to fast track production

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Latin Resources Limited (ASX:LRS) announced on Thursday that it had acquired the Geminis Lithium Mine and Don Gregorio concessions in the western part of the Libertador del San Martin region of San Luis, Argentina through the signing of a Binding Letter of Intent (LOI).

The Geminis mine has been historically linked to lithium mining in San Luis and the presence of high grade lithium bearing pegmatites has been acknowledged. Of particular significance is the established processing facilities in San Luis as this presents a unique opportunity for LRS to fast track production of spodumene concentrate.

Historically, the mine was recognized by geologists from the National Development Bank whose work has been reflected in unpublished reports as one of the main lithium deposits in the province of San Luis with lithium ore produced in the period between 1960 and 1980.

Latin Resources positions itself to move from explorer to producer

Commenting on the strategic benefits of this development, Managing Director of LRS, Chris Gale said, “The acquisition of the Geminis mine is further building Latin Resources’ strategy of controlling all of the known hard rock lithium pegmatites in Argentina, and our goal for this project is to produce a JORC resource while designing and permitting a spodumene plant to add to an existing operation in San Luis”.

Gale noted the additional benefits of securing a known lithium deposit in San Luis province that has had decades of mineral production, has the potential to transition LRS from explorer to producer in a relatively short time frame.

Of course it is early stages for LRS in this endeavour and investors should seek professional financial advice if considering this stock for their portfolio.

To this end, a meeting was recently held with the San Luis Mines Department to determine the permitting of a spodumene circuit into an existing operational plant. The mining authorities suggested that it would be a matter of “only a number of months” to have a spodumene production circuit approved into an existing operating plant.

This would dispense with the normal lengthy process of gaining approvals when constructing a new plant.

The cost saving benefits in adding a spodumene circuit into an existing plant are also substantial, which not only contributes positively to the economic viability of the project, but it could also potentially make the pathway to financing such a project far more streamlined

Small scale production already in progress with established infrastructure

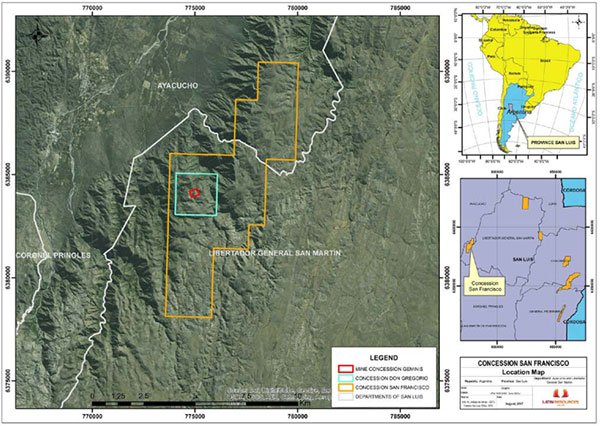

The Geminis Mine (12 hectares) and surrounding Don Gregorio (388 hectares) exploration concessions are located approximately 8 kilometres to the south east of the village of San Francisco del Monte de Ore and 18 kilometres to the north of the historical gold mining centre of La Carolina in the Sierra Grande de San Luis mountain range.

LRS’s San Francisco exploration concession completely surrounds the Geminis and Don Gregorio concessions as indicated below.

There are two possible access routes to the mine, one of which is the original access track by which ore was transported from the Geminis mine to the south to reach the main road to the La Toma processing facilities.

San Luis Province has an established small mining industry that actively produces quartz and feldspar from hundreds of small mines for the glass and ceramics industry. There are around 100 miners in all, of which the top 5 might produce nearly 75% of the total minerals.

Broad range of economic minerals provides prospect of non-lithium credits

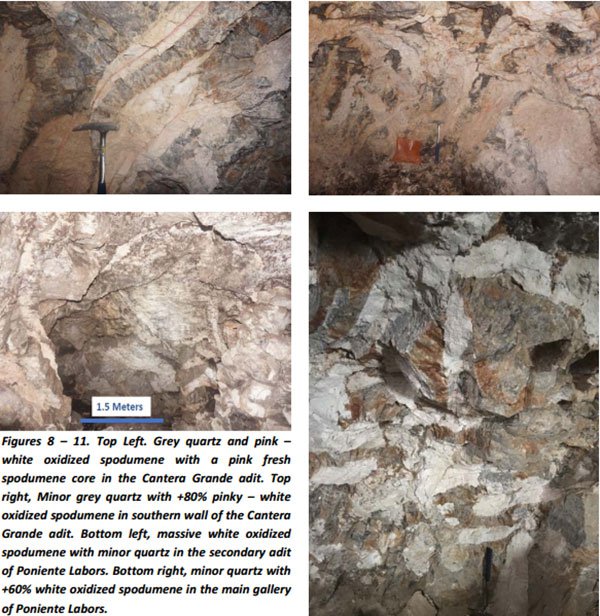

The pegmatites located at the Geminis mine are of the complex spodumene type. A broad range of economic minerals are present, and significantly there is intense spodumene mineralisation with parts of the mine comprising up to 80% of the material.

In the course of previous mining activities, individual spodumene crystals were measured to have a length of up to 4 metres. Other minerals which are significant and may contribute to the overall value are the lithium minerals amblygonite and lithiophilite, found within the pegmatite’s non-nucleus zones as are other minerals tantalite, columbite and beryl.

These non-lithium minerals being present is significant as they can contribute as credits in the production of spodumene concentrate.

Following inspection of the central and southern adits. LRS noted that each adit, and the mine workings contained within, have exposed walls that contain extremely high percentages of oxidised spodumene as illustrated below.

Gale highlighted the fact that these exposures are by some distance the best spodumene mineralisation seen by Latin technical staff in Argentina.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.