Latin Resources to acquire highly prospective lithium concessions in Argentina

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

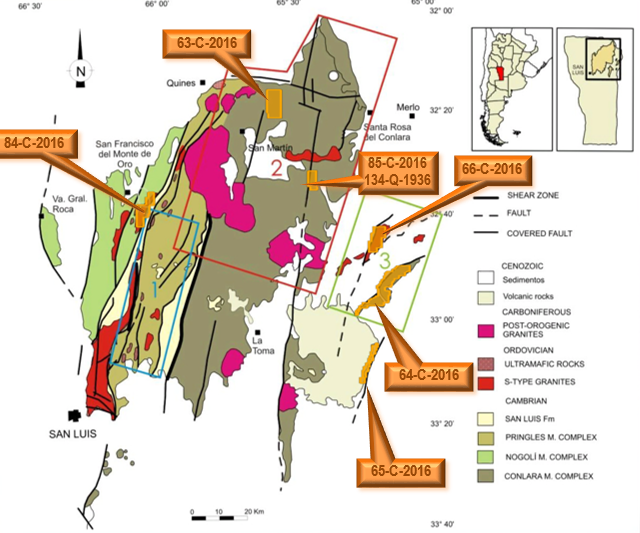

Latin Resources (ASX:LRS) continues to build on its strategy of accumulating prospective lithium bearing territory in Argentina having lodged claim applications in relation to six exploration concessions and one vacant lithium mining concession relating to tenements located in the San Luis province of Central Argentina.

Each of the six exploration concessions surround pegmatite dykes known to have been mined in the past for lithium minerals such as spodumene and lepidolite, and/or other related minerals including quartz, feldspar, beryl, tantalite and colombite.

In another important development LRS has claimed the “Maria del Huerto” mining concession, comprising three parallel dykes where spodumene was mined between 1936 and 1940. The main working at this site measures 110 metres x 15 metres and has been excavated to a depth of 10 metres.

It should be noted that Latin Resources is an early stage exploration company and investors shouldn’t base financial decisions on anticipated exploration results. Investors should seek independent financial advice if considering this stock.

Though LRS’s share price has increased some 30% since early September, investors considering this stock should also be aware that historical share price trends may not be replicated.

Maria del Huerto one of the first spodumene producers in the San Luis province

This was one of the first deposits mined in the Saint Luis province and was known to have robust grades. Despite only having explored to relatively shallow depths at that site, spodumene crystals of up to one metre in length were recorded at the time of excavation.

The company expects to commence drilling at Maria del Huerto in 2017, and at this point it should be noted that the company is funded for its upcoming drilling campaign at Catamarca where compelling drill targets have now been identified in two lithium pegmatite districts of Argentina.

While Catamarca remains the near term focus, there is no denying the significance of the pending addition of nearly 25,000 hectares in the San Luis province, as this would see LRS owning the lion’s share of the known hard rock lithium pegmatites in Argentina.

Also, the acquisition of further tenements within Argentina should be well received by investors given that it is consistent with management’s stated goal of building a strong position in that country.

The following shows the location of LRS’s new exploration and mining claims (orange polygons) prospective for lithium bearing pegmatites in north-eastern San Luis province, Argentina.

Catamarca remains the main game

As a backdrop, analysis of four samples collected by geologists in relation to exposures of spodumene in old mine workings in two pegmatite deposits within the group’s Catamarca claim applications reported grades of up to 7% lithium dioxide.

LRS now has access to a number of mineralised positions at Catamarca, and after raising $3.4 million the company is well positioned to progress its proposed drilling campaign which will occur between November and January.

The release of exploration results in coming weeks and months has the potential to provide share price momentum while management beds down the applications for additional licenses announced today.

Maria del Huerto

The addition of a known lithium bearing mine in Maria del Huerto provides a degree of certainty regarding the prospect of bringing that asset into production at a relatively early stage, which could potentially assist in funding development of the group’s other projects.

LRS expects to have completed environmental studies and have drilling permits approved by early 2017, providing the company with the prospect of quickly defining a JORC code mineral resource should the data produced allow such estimates to be prepared.

Summing up these developments, Managing Director Chris Gale said, “We are very excited to have increased our lithium footprint into San Luis which we are confident will contribute to our aim of proving up significant lithium resources over the coming months”.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.