Landmark White enters acquisition agreement and expands footprint

Published 10-OCT-2018 08:53 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Independent property valuation and consultancy firm, Landmark White (ASX:LMW) has today informed the market of its agreement to acquire the property valuation firm, Taylor Byrne.

LMW has entered into agreement to purchase 100% of Taylor Byrne, a move first reported by Finfeed on 8 October.

The acquisition is a calculated move by LMW that will advance the company’s geographical footprint and cement its position as the largest ASX listed valuation services business.

The move will enable LMW to substantially reduce costs as it internalises current third part contracts and spreads the work across Taylor Byrne’s offices.

Taylor Byrne is a revenue generating business ($22.7M last financial year) and has been in operation since 1960. Since commencing operations in Brisbane, the company subsequently expanded throughout Queensland and NSW.

LMW’s acquisition target offers a full range of valuation services, with over 90 valuers operating across Australia’s eastern seaboard. The acquisition will also hand LMW a full suite of valuation services along with strong portfolio valuation and property consultancy divisions, including a well-performed rural division.

Along with cost synergies through the two operations with shared overheads, the acquisition is set to deliver sustainable and diversified top-line growth, with the transaction anticipated to be Earnings Per Share accretive in FY19 with full effects expected to be realised in FY20 of circa 1.8 cents.

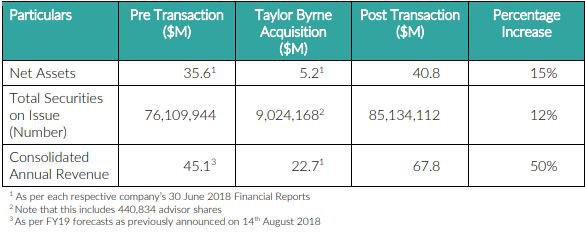

The following table indicates the expected financial effect of the transaction.

Put simply, the advantages of this acquisition are threefold:

- Increased revenues

- Increased margins

- Larger geographical footprint.

Chris Coonan, LMW Chief Executive Officer said of the acquisition: “In line with our previously stated acquisition strategy, we have continued to evaluate opportunities for growth. We are conscious of the benefits of expanding a geographical footprint, and Taylor Byrne is an ideal fit for that goal. We eagerly look forward to delivering the benefits of additional scale, capacities and sustainable earnings growth for our shareholders, and continuing to provide LMW’s personalised and streamlined service for our existing and new clients.”

Timothy Rabbitt, Taylor Byrne’s Chief Executive Officer was also positive: “This transaction represents an exciting next step for Taylor Byrne. Our employees and clients stand to benefit from the combined capacities of the two businesses, and we very much look forward to working with LMW to build a much larger property services business.”

Acquisition details

The acquisition of Taylor Byrne provides LMW with a further aligned/incentivised registry, with 50% of the acquisition consideration being provided in shares. The vast majority of Taylor Byrne shareholders, who are current employees, will continue to be employed by LMW.

The terms of the acquisition are as follows:

- Total consideration value of AUD10,300,000, based on a 4.5x normalised FY18 EBITDA multiple payable as:

- AUD5,150,000 cash consideration; and

- 8,583,333 fully paid ordinary shares in LMW at a deemed issue price of AUD0.60 (Consideration Shares).

- The share consideration will be subject to voluntary escrow, with one quarter of the shares released every 6 months, with the first release to occur one year from Completion.

As the cash component will be funded out of existing cash reserves and financing facilities, there will be no new share issuance other than the Consideration Shares along with 440,834 shares issued to settle advisor fees associated with the transaction.

By structuring the transaction through voluntarily escrowed share consideration, the acquisition aligns Taylor Byrne’s 24 Shareholders, each of whom are existing employees, directly with LMW’s vision and goals.

Completion of the acquisition and issue of Consideration Shares to Taylor Byrne shareholders is expected to occur no later than 31 October.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.