Kingston Resources kicks off critical drilling program at Misima Gold Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. FinFeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

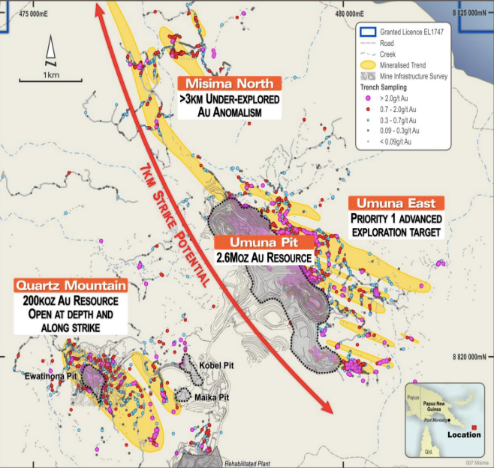

Metals explorer, Kingston Resources (ASX:KSN), today informed the market that it is set to begin a major drilling program at its Misima Gold Project in Papua New Guinea.

A long-term diamond drill contract has now been awarded. The priority focus of the initial program will be a series of highly prospective gold targets within the Umuna East target area, with the intention to expand the current JORC Resource, which sits at 2.8 million ounces of gold.

Diamond drilling is scheduled to kick off in April and run until late December. Mobilisation of the drilling rig, consumables and equipment via barge from Lae, PNG, will begin in March.

Preparations for earthworks for drilling platforms are already underway. Encouragingly, the successful drilling contractor has a 25-year track record of safe and productive exploration drilling within PNG and the Asia-Pacific region.

KSN has also commissioned a study of the structural controls on mineralisation at Misima with an independent consulting geologist. This study, which begun early this month, is expected to be completed in March. The results of the study are expected to provide KSN’s geological team with an enhanced understanding of the structural architecture controlling mineralisation on the project —especially in relation to targets where structural and lithological controls are likely to have produced high-grade mineralisation.

An airborne LiDAR survey of the project is also expected to be completed in the coming quarter. This will provide the first high-resolution terrain model of the whole project, enabling additional information to be merged with mapping data, as well as allowing KSN to design future drilling locations with increased confidence. Interestingly, LiDAR has the benefit of being able to penetrate through rainforest foliage, resulting in a high-resolution 3D scan of the earth’s surface.

However, it is an early stage of this company’s development and if considering this stock for your portfolio, you should take all public information into account and seek professional financial advice.

KSN managing director, Andrew Corbett, said: “Given the short time frame from completing the merger with WCB to awarding the drill tender, I’m extremely proud of the Kingston team’s efforts to advance the world class Misima Gold Project. The exploration potential that has been identified outside of the current 2.8Moz resource provides the Company with an immediate opportunity to add further ounces to the already substantial resource.”

“The initial drill targets have been generated by reviewing historical Placer data in the light of recent field work carried out by Kingston Resources. These targets are currently being cross-referenced with the independent structural review which is due to be completed in March,” Corbett added. “The historic Placer work provides walk up drill targets left untested when Placer ceased operations during a sub US$300/oz gold price environment.”

“Kingston’s proposed drilling program is the first gold drilling program carried out on Misima for nearly 20 years which is exciting, considering the historical operation produced over 3.7Moz of gold at U$218/oz and left behind a substantial resource. The company currently has a 49% interest in the Misima Gold Project which will increase to a 70% interest following further expenditure of A$1.8m, budgeted in the next six months,” said Corbett.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.