JAT to exhibit in-house brands at world’s largest trade fair

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

ASX supply chain play, JAT Energy (ASX:JAT), has secured exhibition space at the 18th Shanghai International Children Baby and Maternity Products Industry Expo, which will take place from July 25-27.

JAT is a China-Australia cross-border specialist in Fast Moving Consumer Goods (FMCG) exports. The company develops in-house brands for Australian products for sale offline and online, with a focus on the Chinese market — especially milk products.

JAT’s 18 square metre exhibition space will showcase its rapidly expanding portfolio of in-house products, including:

Golden Koala

- Premium Infant Formula (Stage I for newborns to six months)

- Premium Follow-On Formula (Stage II for six to twelve months)

- Premium Toddler Milk Drink (Stage III for one to three years)

- Full Cream Instant Milk Powder

NEURIO

- Lactoferrin Milk Powder

- DHA Algae Oil Softgel

Cobbitty Country

Golden Koala and NEURIO product samples and information will be made available to visitors; brochures will also outline the range of products Cobbitty Country plans to release in the coming months.

JAT will be supported by Shanghai Dragon Corporation staff in both the exhibition space and at private meetings with agents, distributors, wholesalers and retailers.

JAT executive director, Wilton Yao, said: “These trade fairs offer excellent brand exposure. More importantly, visitors are trade professionals looking for new products and new suppliers and planning to place orders.”

Yao noted that JAT’s exhibition space is ideally situated in the ‘Australia’ pavilion, adjacent to the ‘Fabulous Mom Zone’.

However it is an early stage of this company’s development and if considering this stock for your portfolio you should take all public information into account and seek professional financial advice.

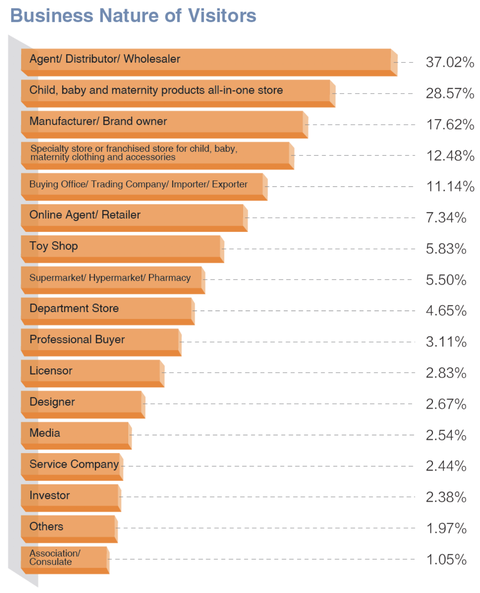

The CBME China 2017 Post-Show Report showed that almost all visitors were professional buyers, while 89 per cent of visitors attended with the purpose of placing orders, as shown below:

This pleasing development comes on a veritable wave of newsflow from JAT. Last week, JAT revealed that JD Global, China’s largest retailer by revenue, has approved the sale of Sunnya’s Neurio-branded products (Sunnya is one of JAT’s subsidiaries). The Neurio range will be sold to Chinese consumers on JD Global’s cross-border and supermarket platforms, www.JD.com and JD.hk.

Only days before that — and in the wake of a deftly engineered distribution deal with Cyclone E-Commerce for over $7.5 million in single product revenue — JAT also announced that its subsidiary, Golden Koala Group, has developed a new OPO formula for milk products for the Australian and overseas markets.

This all seemed to meet shareholder approval, given that JAT is on an upward trajectory, currently up 12.1 per cent, sitting at 7.4 cents.

Past performance is not necessarily indicative of future results. As part of the due diligence process, clients must consider all factors over and above the past performance of the product. Clients should not engage with a product solely on it past performance.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.