Ironbark Zinc receives all-important mining permit for Citronen

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Trent Barnett from Hartleys who has an intimate understanding of the company and is close to developments within the group had said in an earlier note, “We expect the award of the mining license any day, although we have already been disappointed substantially this year on timing”.

However, we felt the ‘any day’ choice of words perhaps indicated Barnett knew something was in the wind and as it turns out less than a fortnight later the permit has been granted just in time for Christmas for IBG shareholders.

Such a development appeared sure to generate share price support for the stock and when it was announced on Monday morning the company’s shares traded as high as 12.5 cents, representing an increase of 14% compared with the previous closing price.

Potential investors should not make assumptions regarding past or future share price fluctuations, nor should they use forward-looking statements provided by the company or brokers as the basis for an investment decision. IBG is a speculative stock and independent financial advice should be sought prior to investing in this company.

This rerating occurred under particularly strong volumes with approximately 7 million shares traded in the first hour. Average daily trading volumes in November were 1.3 million.

Also illustrating the significance of this development, this morning’s peak represented a 12 month high for the company.

A financially compelling project

Based on the Bankable Feasibility Study (BFS), the Citronen zinc-lead project demonstrates compelling metrics. According to the BFS, it is a large-scale, long life project with an expected mine life of 14 years during which it is expected to generate revenues of approximately US$5.6 billion.

While a significant amount of capital is required to bring the project into production (circa US$430 million), the payback period based on the BFS metrics is only 18 months.

While a long-range project because of the extensive construction required to bring it into production, Barnett’s modelling indicates that by 2021, based on spot prices the project would generate EBITDA of $369 million from revenues of $727 million, implying margins of 51%.

Management looking to accelerate development and funding

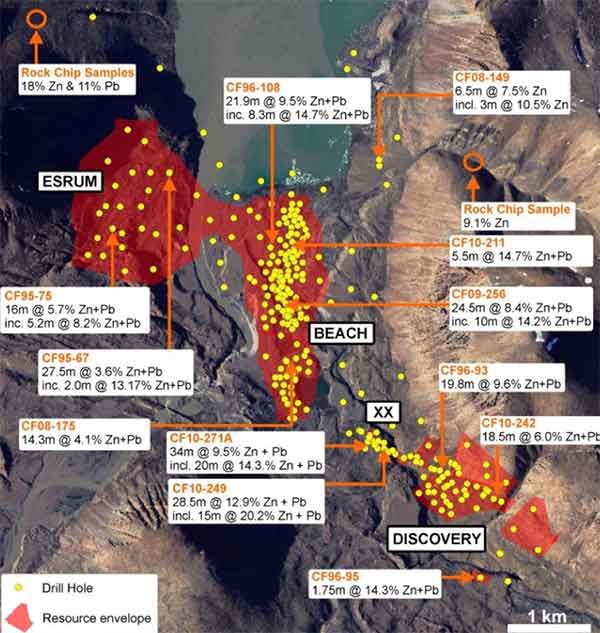

The following demonstrates the size of the project and the impressive exploration results achieved to date.

Commenting on the granting of the permit, Managing Director Jonathan Downes said, “This is a milestone and achievement of great importance to the company and our plans to develop the project into one of the world’s largest zinc mining operations, and we will now move to advance project development and funding without delay”.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.