Inca confirms high grade mineralisation in vein assays at Riqueza

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Inca Minerals (ASX:ICG) opened 20% higher on Tuesday morning after the company announced very high grade assay results at its Riqueza project in Peru.

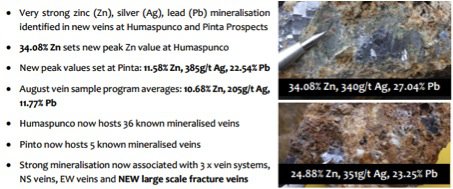

More than half of the 33 assay results released today have a combined zinc-lead grade in excess of 20%. Included in the assay results are peak values for zinc, lead and silver of 34% Zn, 27% lead and 427 g/t silver respectively. The Company has also advised today that these assays were taken from veins at two of the prospects within the project (Humaspunco and Pinta) and that assays for mantos taken from the same prospects are pending.

While this news could provide further share price momentum, it should be noted that the company’s trading history is not an indication of future performance and as such, this shouldn’t form the basis of an investment decision and professional financial advice should be sought.

This builds on positive news released at the end of August regarding the discovery of 17 new veins and 14 mantos (a flat lying, bedded or deposit usually copper, lead, zinc, silver – terminology mainly used in South America for a hydrothermal replacement deposit of carbonate beds).

It was highlighted by management at that stage that the manto sequence appeared to extend over a strike of 2 kilometres with 13 of the newly discovered mantos relating to the Humaspunco prospect.

The Company is advising that assay results to date confirm a high grade and extensive network of mineralised veins and mantos with average grades from just the veins sampled in the most recent program being 10.7% zinc, 205 grams per tonne silver and 11.7% lead (manto assays are pending).

Inca’s Riqueza project story could improve even further once the company receives results concerning new manto occurrences.

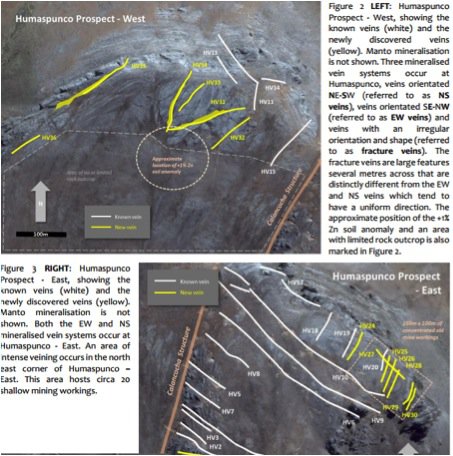

The strong grades across each mineral category and the associated geological formations that have been intersected suggest that Humaspunco could be part of a large system that may host a commercial zinc, silver, lead deposit.

However, it should be noted that these are only early stage results and shouldn’t be used as a basis for estimating a likely mineral resource. As such, these shouldn’t form the basis of an investment decision and professional financial advice should be sought.

More clarification should come to light with drilling and on this note Managing Director, Ross Brown said, “As we approach drilling, I fully expect the total number of veins to increase to the extent that Humaspunco may be viewed as a single network of criss-crossing mineralised systems with veins repeating at all scales”.

While stating it was inappropriate to provide any estimate of tonnage at this time, the Company noted that, in the event the newly discovered mantos are of similar grades to those reported today, then it had every reason to be extremely optimistic about the scale and potential of the Riqueza project and future work will focus on moving towards exploration target estimates and a possible maiden resource.

In the near term, detailed stratigraphic analysis of the manto samples is currently determining the relative position of each new manto occurrence identified in the August program to assess how many new mantos horizons were discovered.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.