Impressive assay results for Inca Minerals’

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Inca Minerals (ASX:ICG) surged 25% in morning trading after the company released a double dose of promising news following the return of assay results from a reconnaissance rock chip sampling program conducted in the southern part of the Riqueza Project and an adjacent area in the new Palcacandha Project.

It should be noted that share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

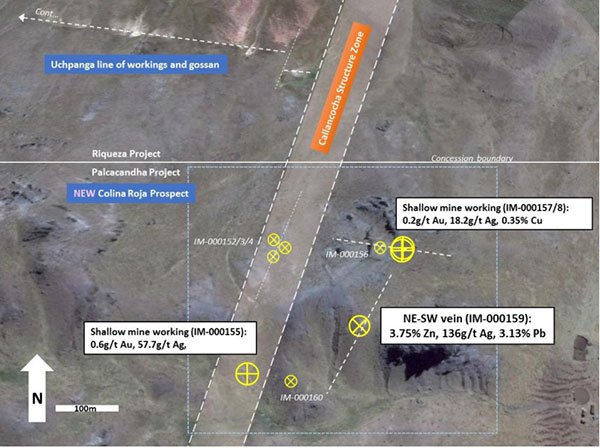

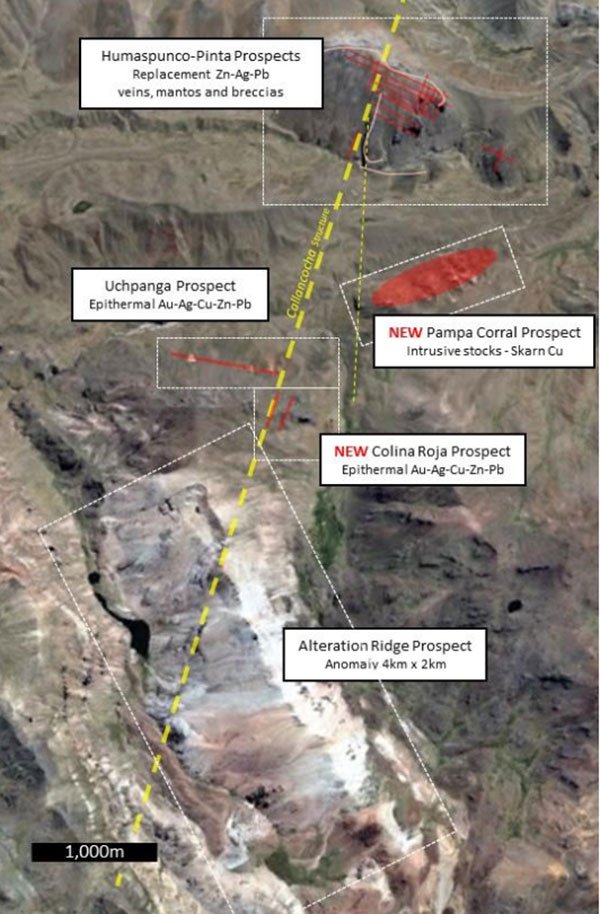

Two specific areas were targeted by this program, one area hosting several recently identified mine workings and outcropping vein structures comprising the new Colina Roja prospect, and the other hosting the monzodiorite and meta-gabbro intrusive stocks comprising the new Pampa Corral prospect.

The assay results indicated high grade zinc-silver-lead associated with a new vein, elevated gold associated with several new veins and stockwork zones, and elevated copper associated with a margin of the intrusive stocks.

The identification of new prospect areas in the greater Riqueza area comes at a time when two further concessions have been granted to the Company. With assay results for drill holes RDDH003/004/010/011 imminent, the greater Riqueza area is rapidly expanding into a large, multifaceted highly prospective project.

A high-grade zinc-silver-lead vein has been identified at the new Colina Roja prospect in the Palcacandha Project. The vein, exposed in outcrop, has a northeast-southwest strike direction, sub-paralleling several other veins that occur in the immediate area.

Importantly, as can be seen below the Callancocha Structure trends into this area on the same approximate bearing.

Preliminary sampling of the Colina Roja vein indicates a strong grade of 3.75% zinc, 136 grams per tonne silver and 3.1% lead with elevated gold, copper and strong manganese.

ICG noted that the vein was brecciated, gossanous and strongly weathered. The metal mix of the vein is very similar to that of the high grade vein/dyke at Uchpanga, located 500 metres to the south-west.

The recent mapping and sampling program at the Colina Roja Prospect has also identified several veins and stockwork zones that contain significant levels of gold and silver, and in some instances, copper.

The gold grades in the veins and stockwork zones are between 0.1 grams per tonne and 0.7 grams per tonne, significantly above the estimated background levels of gold in unmineralised rocks of this area. Peak silver includes 57.7 grams per tonne (ppm) and peak copper includes 0.36% copper.

Commenting on these developments, ICG’s managing Director, Mr Brown said “Strongly elevated gold and silver and in some cases, copper, in numerous veins, with different bearings, veinlets and stockwork zones indicates a pervasive mineralising event at this new prospect”.

He is of the view that even at this early stage in exploration, this outcome adds considerable prospectivity to the combined Uchpanga-Colina Roja prospect area and further depth to the greater Riqueza project area.

This is reaffirmed when observing the location of the Colina Roja Prospect, which as can be seen below is in line with the northeast-southwest trending Callancocha Structure, between Humaspunco to the north-east and the very large Alteration Ridge hydrothermal anomaly to the south-west.

Several of the gold-silver veins identified by this work fall directly on, and have the same bearing as, the Callancocha Structure trend. This provides strong evidence for the Callancocha Structure playing an important part in mineralisation at Riqueza and Palcacandha.

Highlighting the emerging evidence of a relationship between the various areas under exploration, Brown said, “It is now firmly believed that the Callancocha Structure plays an important role in the distribution of mineralisation within the greater Riqueza project area, providing a nexus between the Humaspunco, Uchpanga, Pampa Corral, Colina Roja and Alteration Ridge prospects”.

Exploration strategy includes targeting of new prospects

ICG’s strategy in the near term will be to conduct mapping and sampling at new prospects, including the Colina Roja prospect which it views as very attractive with a known high grade zinc-silver-lead vein, as well as numerous veins, joint structures and stockwork zones identified in recent reconnaissance mapping.

In the coming weeks and months, ICG intends to undertake detailed mapping and sampling of Colina Roja, combined with reconnaissance mapping and sampling of the nearby Alteration Ridge prospect.

The copper skarn at the Pampa Corral prospect will also be further investigated.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.