Impression Healthcare makes impressive debut on ASX

Published 22-NOV-2016 12:09 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Impression Healthcare (ASX: IHL), formerly Mt Magnet South (ASX: MUM), made its debut on the ASX on Tuesday morning having successfully raised $3 million at 8 cents per share in a heavily oversubscribed raising.

The company received strong support in early trading, hitting a high of 9.9 cents in the first 10 minutes, representing a premium of nearly 25% to the capital raising price.

Potential investors should note that this is still an early stage play and share price trends should not be used as the basis for an investment decision, and independent financial advice should be sought if considering this stock.

Leading the way in consumer custom fitted mouthguards

IHL is an Australian national manufacturer and supplier of custom fit mouthguards with a variety of ways for the consumer to access a product which is deemed as affordable, customisable and convenient in terms of ordering, with the option to complete all facets from dental impression through to online ordering and free delivery without having to visit a dentist.

The current sale price of its Gameday mouthguard is $85, substantially below the cost of mouthguards fitted, made and sold by dentists.

Scope for substantial growth

In terms of the addressable market, it is estimated by the Australian Bureau of Statistics that 2.1 million Australians play what may be defined as a contact sport in Australia with 1.4 million in the 4 to 14 years age bracket and 700,000 in the 15 and above age range.

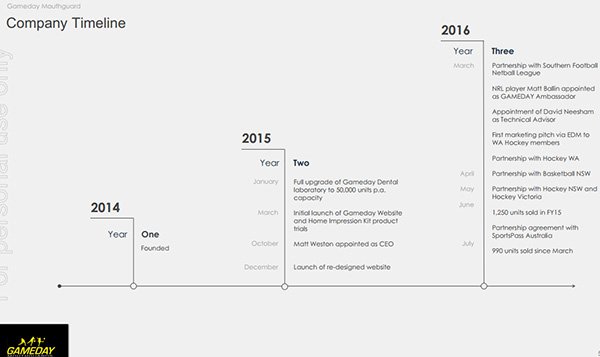

IHL generated sales of 1250 in fiscal 2015 and the management team led by sports marketing executive, Matt Weston, believes there is scope to grow sales substantially given there has been minimal marketing spend to date.

Weston is a well-known sports ambassador who worked with the San Antonio Spurs in the National Basketball Association and was a technical director for the Beijing 2008 Olympics.

As IHL debuted on the ASX, management announced that it had also gained the support of high profile professional women’s AFL players, Moana Hope and Kaitlyn Ashmore, as Gameday’s latest ambassadors.

With regard to scope for organic growth, the Australian Dental Association reports that only 36% of Australian children aged between five and 17 are wearing mouthguards during games.

Sports Medicine Australia supports custom made and fitted mouthguards

IHL’s Gameday mouthguard is targeting the gap between parents who pay $300 for a custom-made dental mouthguard and the $50 boilerplate over-the-counter variety.

Weston highlighted commentary by Sports Medicine Australia, which is on record as saying, “Custom fitted mouthguards are superior to over-the-counter mouthguards and are made from a dental impression and a plaster model of the teeth which provides the best protection, fit and comfort for all levels of sport”.

Should IHL be able to build sales by converting those not using mouthguards and/or opting for a cheap but arguably less efficient product, it has the capacity to substantially ramp up production with annual manufacturing capacity of 50,000 units.

IHL quick to establish ties with sporting organisations

Often the best way of harnessing growth in the sporting industry is through association with sporting bodies and individual clubs.

On this note, Gameday representatives are equipped to take orders by a tablet with the consumer, facilitating the mass marketing of the product through clubs or schools. There is an added incentive where bulk buying through these channels occurs with the club or school receiving discounts of between 10% and 15%.

IHL has managed to quickly make sound progress on this front since being founded in 2014, as can be seen below.

The company is also looking to grow sales by expanding geographically and launching new products such as teeth whitening solutions, oral and healthcare devices and complementary sporting goods.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.