ICG shares spike as Cerro Rayas returns robust zinc grades

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Inca Minerals (ASX:ICG) has released assay results for samples collected during a brief mapping and sampling program at its Cerro Rayas zinc project in October.

This is the group’s second zinc-silver-lead focused project in Peru, and it is located 15 kilometres from the Riqueza project which is approximately nine months ahead of Cerro Rayas on the exploration curve.

There are strong similarities in mineralisation between the two projects with Riqueza having already delivered impressive exploration results.

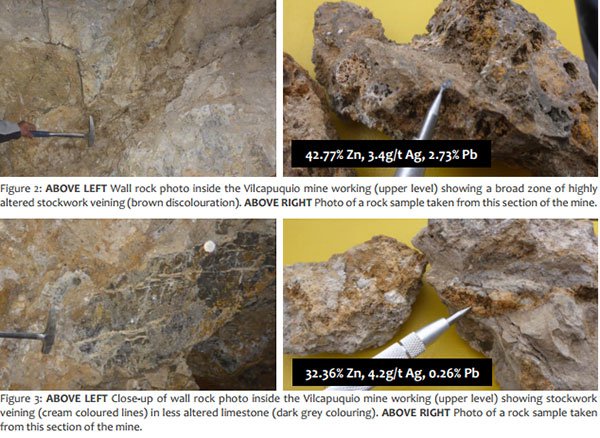

The Cerro Rayas results included peak values of 42.77% zinc, 258 grams per tonne silver and 26.1% lead.

ICG’s shares surged in early morning trading in response to this news, increasing from the previous day’s close of 1.7 cents to hit a high of 2 cents, representing an increase of 17.5%

However it should be remembered that this is an early stage play and share trading patterns should not be used as the basis for an investment. Those considering this stock should seek independent financial advice.

Exploration focused on two old mine workings, Vilcapuquio to the north of the concession and Wari to the south. Working sample averages from both sites featured outstanding zinc grades of 18.8% and 30.5% respectively.

ICG’s Managing Director, Ross Brown highlighted the fact that Vilcapuquio was strongly mineralised in zinc only, while Wari has demonstrated mineralisation consistent with high levels of zinc, silver and lead being contained in the orebody.

A minimum of two high-quality exploration targets at Cerro Rayas

Summing up the significance of these early stage results, Brown said, “Both appear to be separate structure-related mineralised systems almost certainly associated with geological faults, and this being the case we now have a minimum of two high-quality exploration targets at Cerro Rayas”.

From a broader perspective, initial exploration initiatives at Cerro Rayas are focused on determining the characteristics of mineralisation occurring at the two mine workings located within the project area. Understanding the style, strike direction and width of mineralisation, along with other geological factors will assist ICG in shaping future exploration.

From a longer term perspective, management intends to focus on identifying additional zones of mineralisation along known mineralised structures, as well as identifying additional mineralised structures. Several phases of mapping and sampling are planned for 2017, and depending on results ICG will then make a decision as to whether it will progress to drilling.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.