HDY confirms Maiden Mineral Resource at Grace gold project

Published 20-FEB-2018 11:21 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Hardey Resources (ASX:HDY) this morning confirmed that its 100%-owned Grace Project in the Telfer Region of Western Australia has potential for 186,000 ounces of contained gold.

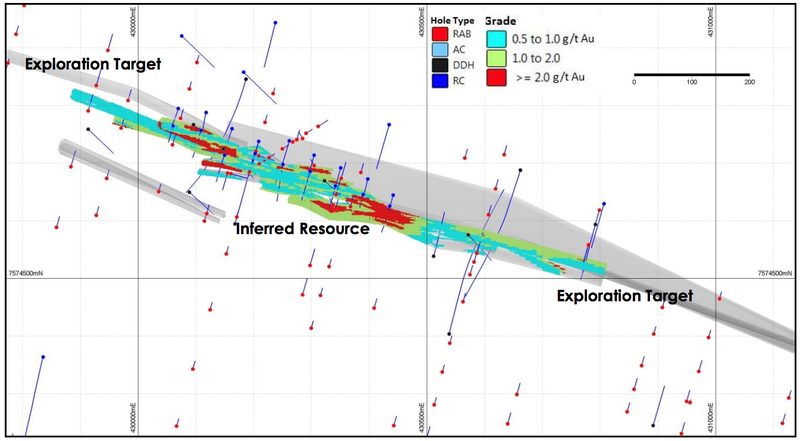

This estimate is based on a maiden Mineral Resource comprising 1.59 million tons at a grade of 1.35 g/t for 69,000 contained ounces of gold (Inferred), plus an additional exploration target for a further 64,000 and 117,000 contained ounces of gold.

The Mineral Resource estimate has been carried out on a portion of the mineralised zone at Grace (1140 metre strike length of a total strike length of 4130 metres). The Resource estimate is supported by drilling at an adequate spacing, and use of appropriate techniques (RC and diamond core). The remainder of the mineralisation is delineated by RAB drilling and wide spaced RC and diamond core drilling.

The Mineral Resource is open along strike and at depth, and does not incorporate the results of the recent review completed by HDY which indicated the potential for high grade mineralisation to be controlled by flat-lying, north-west dipping structures.

At the same time, it’s worth noting that this is an early stage play and investors should seek professional financial advice if considering this company for their portfolio.

In addition to the Mineral Resource, HDY has defined an exploration target of between 2.2 and 2.8 million tons at a grade between 0.9 and 1.3 g/t, which corresponds to a potential content of between 64,000 and 117,000 ounces of gold.

The exploration target is based on mineralisation intersected in both near surface RAB drilling and deep diamond drilling. However, these are conceptual figures and there is insufficient exploration in this area to date to estimate a Mineral Resource.

There was copper mineralisation observed in drilling at Grace but it hasn’t been modelled due to insufficient data spacing. HDY expect to complete further drilling to enable copper-bearing zones to be more accurately correlated with lithological or structural information. This could then be incorporated in any future Mineral Resource estimations.

A drill tender is currently in progress for upcoming drill programmes, while heritage surveys are scheduled for early April.

HDY Executive Director, Terence Clee, commented: “The maiden Inferred Mineral Resource is the first step in building a robust economic gold resource at Grace. The resource modelling has allowed for efficient drill planning for the upcoming drill programs to ensure targeting of the most critical areas to rapidly expand the Mineral Resource.

“The technical team have been diligently working with the necessary third parties to fast-track the on-ground work that will deliver the most value for the company and our shareholders,” he said.

Today’s news follows an announcement by HDY yesterday that Robin Armstrong will be re-joining the company’s board. Armstrong is a former HDY director who has a long association with the company and its Burraga Project.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.