Hardey seeks approvals to reopen Nelly Vanadium Mine

Published 31-AUG-2018 12:03 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Hardey Resources Limited (ASX:HDY) today informed shareholders that it plans to move swiftly to secure the necessary regulatory approvals in order to bring Nelly Vanadium Mine (NVM) back into production as soon as possible.

One of the key reasons for acquiring Nelly Vanadium Mine (NVM), other than the significant potential upside as highlighted by SRK Consulting, is Argentina’s favourable regulations that enable a legacy mining right to be expedited for reactivation compared to other mining countries.

It typically takes three to five years to transform a greenfield project to a viable mining operation in Argentina, but when it comes to expediting the reactivation of a legacy mining right it can take less than 12-months.

To demonstrate HDY’s strategic imperative to re-open NVM, the company has sent a formal letter to the Director of San Luis’ Mining Department (SLMD) detailing the change of ownership and forward plans.

In addition, senior HDY representatives will be travelling to San Luis in early September to expedite the process to re-open NVM. During the visit they plan to meet the SLMD Director and key officials to establish a working rapport; set up a liaison office to manage ongoing activities directly with the SLMD, which includes exploration approval and accompanying Environmental Impact Assessment (EIA) the vendor already submitted; and fast-track the process to reactivate the mining right.

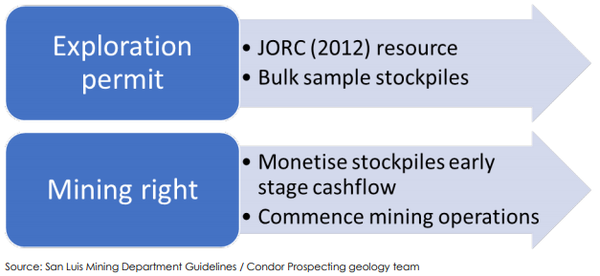

Once exploration approval is granted, the geology team can commence verifying the extent of mineralisation within NVM and bulk sample legacy stockpiles. This will involve quantifying the stockpiles’ mineral potential is the priority before prospective off-take partners undertake independent metallurgical testing.

Once the mining right reactivation is approved, then the stockpiles can potentially be monetised to facilitate generating early stage cashflow, while the technical team works on feasibility plans for optimal open pit mining operations, with forward planning to accommodate future underground mining operations.

Via the Nelly Vanadium Mine, HDY has the potential to jump-start vanadium pentoxide production faster relative to peers with predominantly greenfield assets.

However it is an early stage of this company’s development and if considering this stock for your portfolio you should take all public information into account and seek professional financial advice.

Next steps post-exploration permit and mining right approval

HDY Executive Chairman, Terence Clee commented: “The Board’s immediate core objective is to capitalise on Argentina’s comparatively favourable mining laws to expedite re-opening Nelly Vanadium Mine. Our initial goal, pending the mining right being granted, is approval of the exploration permit. This will enable the geology team to commence work verifying the extent of vanadium mineralisation and potentially monetising the historic stockpiles.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.