Hardey poised to make another vanadium acquisition

Published 19-JUL-2018 12:43 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The vanadium focused Hardey Resources Ltd (ASX:HDY) has entered into a share sale agreement with the major shareholders of Vanadium Mining Pty Ltd (VanMin) regarding a prospective complementary acquisition.

Under the terms of this agreement, HDY has been granted a 40-day option to acquire 100% of the issued capital of VanMin, which is a mineral explorer that owns six highly prospective vanadium projects in Queensland and the Northern Territory.

This initiative supports Hardey’s decision to evolve the company into an emerging vanadium supplier of the renewable energy sector.

This strategy was behind the recent acquisition of the Nelly Vanadium Mine in Argentina.

Should the acquisition go ahead it will also provide the company with geographical diversification.

Although it is early stages in this acquisition so investors should seek professional financial advice if considering this stock for their portfolio.

Targeting shallow surface large tonnage ore

VanMin was established with the principal objective of acquiring vanadium projects in Queensland and the Northern Territory.

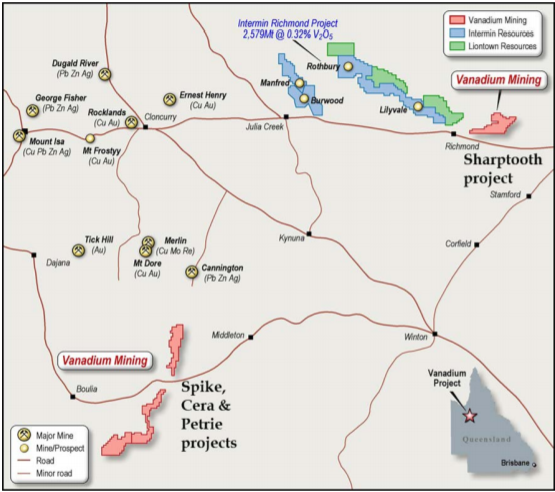

The company owns four projects in the Mount Isa region of western Queensland, being Sharptooth, Spike, Cera and Petrie.

These projects indicated below are located in an area that favours shallow surface mining for large tonnages of low-grade vanadium mineralisation.

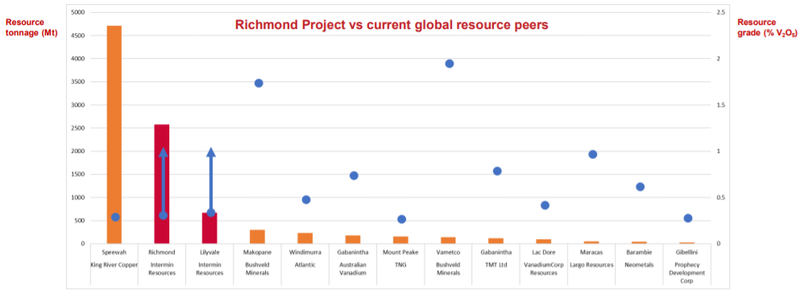

As can be seen above, these four highly prospective areas are to the south of Intermin Resources’ (ASX:IRC) globally significant Richmond project (inferred mineral resource 2,579 million tonnes at 0.32% vanadium cut-off grade of 0.29% V2O5), one of the world’s largest vanadium deposits.

Within the Mt Isa region, the Toolebuc Formation is increasingly recognised for elevated vanadium potential.

Furthermore, areas known for the prevalence of oil shale usually have occurrences of vanadium and uranium mineralisation.

This combination of mineralisation is typically found within the Toolebuc Formation and is consistent with the underlying geology apparent at IRC and (Liontown Resources) respective projects.

Evidence of vanadium boreholes

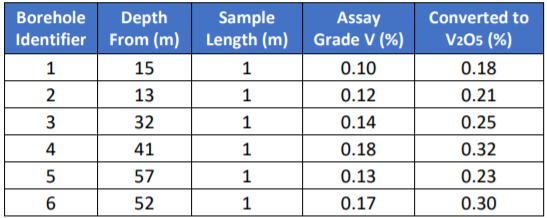

Across VanMin’s four Queensland projects, there is clear evidence of elevated vanadium levels in historic boreholes drilled within the Toolebuc Formation.

Management also noted that there have been numerous historic reports and research confirming that VanMin’s four projects, and the greater region, are generally prospective for vanadium mineralisation.

Based on this legacy work, primary and secondary targets that align with the Toolebuc Formation outcropping have been selected for follow-up fieldwork to confirm the potential for vanadium mineralisation.

Northern Territory assets close to near-term producer

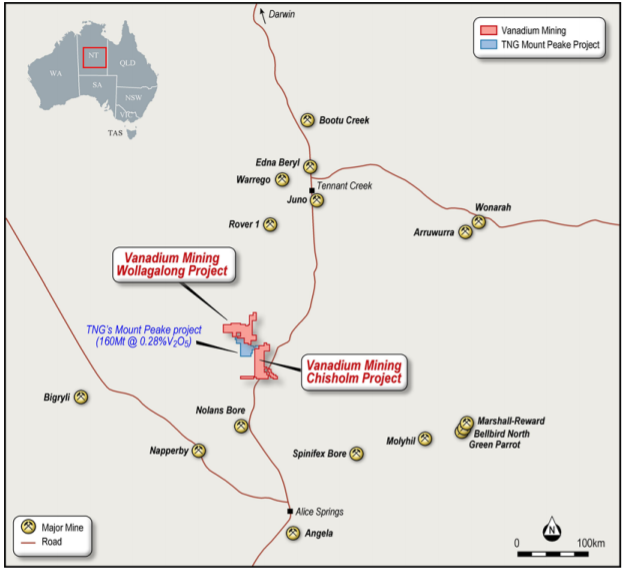

VanMin’s two projects in the Northern Territory, Wollagalong and Chisholm, are contiguous with TNG’s (ASX:TNG) Mt Peake vanadium-titanium-iron project which has a total resource at 160 million tonnes at 0.28% vanadium with a cut-off grade of 0.29% vanadium.

TNG’s project is the most advanced in the region as a Definitive Feasibility Study (DFS) has already been completed, while TNG has also signed a binding life of mine offtake and technology transfer agreement with Korea’s Woojin Metals.

TNG updated the economics of its DFS for Mount Peake in November 2017, confirming a world-class project capable of generating life of mine cash flows of $11.7 billion with an NPV8 of $4.7 billion.

Consequently, if nearology comes into play through the identification of similar mineralisation and grades Wollagalong and Chisholm could become prized assets.

Both VanMin projects are in a region with higher grade mineralisation that is associated with ore bodies with the potential to be selectively mined by open pit methods.

Moreover, Wollagalong and Chisholm cover the highly prospective Arunta Orogen, which hosts TNG’s Mt Peake vanadium deposit.

Titanium and iron could come into play

Both VanMin projects have similar geological and magnetic features to TNG’s declared resource for vanadium, titanium and iron.

Hardey also expects they are highly probable to be gabbro-hosted magnetite deposits which underlie the Mt Peake deposit’s vanadium-iron-titanium mineral resources.

The promising supply-demand dynamics regarding vanadium have been well documented, and this has contributed to the sharp rise the commodity price as indicated below.

Consequently, Hardey’s timing in taking an aggressive approach to acquiring highly prospective territory appears to be an astute move.

Management expects the acquisition which involves a share sale process will be settled by early September.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.