Hardey doing the ground work at Nelly

Published 24-JUL-2018 12:59 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Hardey Resources Ltd (ASX:HDY) has appointed two experienced groups to progress the due diligence work on the Nelly Vanadium Mine (NVM) in Argentina.

Global multi-disciplined group, SRK Consulting which has an office in Buenos Aires with an experienced team of geologists has the capacity to undertake services from exploration through to feasibility, mine planning, and production.

Given Hardey’s intentions of achieving a relatively quick restart at NVM, SRK’s expertise across the areas of due diligence and feasibility studies will be invaluable.

Hardey will also benefit from Argentinian-based Condor Prospecting’s local knowledge with its areas of expertise including data management, due diligence, exploration, tenure management and the all-important EIA processes which will be helpful as the company looks to restart NVM.

Condor will be working collaboratively with SRK with the latter being the lead consultant.

Some of the key focus areas include the assessment of mineralised veins identified in earlier studies, and if practical a determination of the dimension and extent of underexploited mineralisation.

There is clearly still a lot of work to do on this front, so investors should seek professional financial advice if considering this stock for their portfolio.

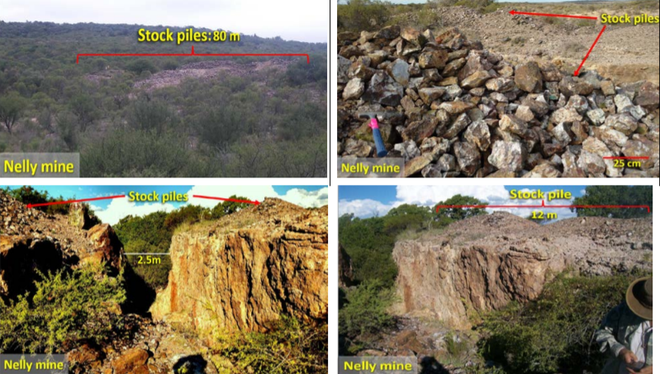

The group will take updated measurements of the substantial legacy stockpiles which surround the open pit, processing plant and workings as these could potentially be a direct shipping ore vanadium product, contributing to cash flow at an early stage.

The extent of these stockpiles can be seen below.

The information gathered should form the basis of an assessment to determine qualitatively and quantitatively the potential upside for vanadium, gold, silver, copper, zinc, lead, molybdenum and bismuth mineralisation at NVM.

It should also assist Hardey in establishing a JORC Resource at the project.

Hardey has performed well in the last week on the back of developments with NVM and the proposed acquisition of vanadium prospective tenements in Queensland and the Northern Territory.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.