Graphite results and proposed acquisition to bring Ardiden under the spotlight

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

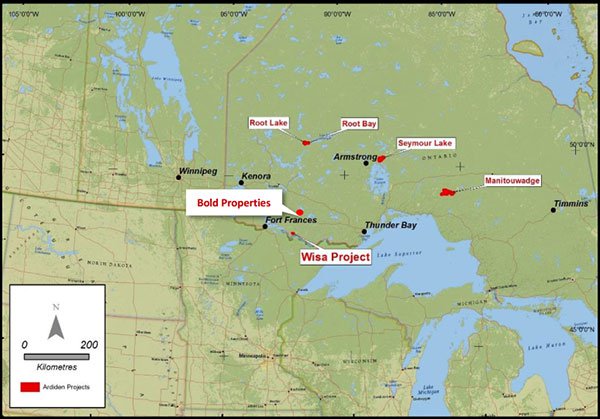

Strategic international metals group, Ardiden (ASX:ADV) has released important news regarding its graphite project located in Canada, as well as advising the market that it has entered into an option agreement to acquire a cobalt-copper-nickel project in Ontario.

The latter was originally discovered in 1992 and during a period of subsequent exploration a number of sulphide zones were identified, confirming the potential for cobalt, copper and nickel mineralisation.

While this was only a grab sampling program, the returned non-JORC grades of 0.3% cobalt 5.54% copper and 0.7% nickel provide some insight into the project’s prospectivity.

Of course, this is an early stage play and investors should seek professional financial advice if considering this stock for their portfolio.

The proposed acquisition is the Bold Property Project located 50 kilometres north-east of the town of Mine Centre in Ontario, less than three hour’s drive from Thunder Bay, a leading regional mining jurisdiction in Ontario with key local infrastructure including a skilled mining workforce and excellent local logistics and infrastructure.

Entering the cobalt space should be seen as a positive move given the company’s broader focus on new age metals with applications in power storage such as lithium and graphite.

ADV is currently progressing the Seymour Lake and Root Lake lithium projects (both located in Ontario, Canada), and there is the proposed acquisition of the Wisa Lake lithium project in the pipeline.

Ardiden releases initial assay results from Manitouwadge graphite project

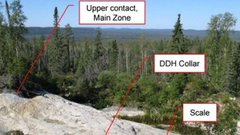

However, it could be ADV’s progress at its graphite project that ignites investor interest on Monday morning after the company announced initial assay results from its Manitouwadge graphite project in Ontario after the market closed on Friday.

This jumbo flake graphite project covers an area of 5300 hectares and has a 20 kilometre strike length of electromagnetic anomalies with graphite prospectivity.

Preliminary metallurgical test work indicated that up to 80% of the graphite at Manitouwadge is high value jumbo or large flake graphite. Test work also indicated that simple, gravity and flotation beneficiation can produce gravity purity levels of up to 96.8% for both jumbo and large flake graphite.

The average grade of the graphite mineralised zones in each of the diamond drill holes ranged from 1.4% to 3.9% total graphitic carbon.

Management said some of the holes intersected multiple high-grade lodes within the broader mineralised envelope, including impressive individual grades of up to 24.5% total graphitic carbon.

The results of assays taken from 16 other holes are imminent.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.