Graphite prices on the rise as price pinch starting to be felt

Published 27-SEP-2018 13:46 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The equation looks simple; the supply of graphite is tightening, while the demand is currently forecast to skyrocket.

While you might be most familiar with graphite as the substance that is used in pencils, a surge in the demand for drawing implements is not what is driving the globe towards a potential shortage of several million tonnes per annum over the next ten years. Nor are artists and illustrators responsible for the forecasted growth in price; the early signs of which have already been seen in the first two quarters of 2018.

Graphite is a key component in lithium-ion (known as li-ion) batteries, used in electric vehicles. The amount of graphite used in car battery anodes is insignificant; a lithium-ion battery in a fully electric Nissan Leaf contains almost 40kg of graphite.

Meanwhile, as US car manufacturers who are pivoting towards electric vehicles become more reliant on a steady supply of graphite being available, the Trump administration’s latest round of tariffs have levied a 10% tariff on all graphite being imported from China. For its part, China has begun closing down several major graphite producing mines as part of a crackdown on unsafe and environmentally damaging practices in the industry. In fact, China is now set to be a net importer of graphite for the first time in the wake of these closures and additional regulations.

As a result, the price of flake graphite is already on the rise, having increased in the first two quarters of 2018. This is particularly notable because it comes on the back of a slightly slowing of demand for electric vehicle batteries, which has impacted the prices of lithium and cobalt, two other significant components in the batteries used in EVs.

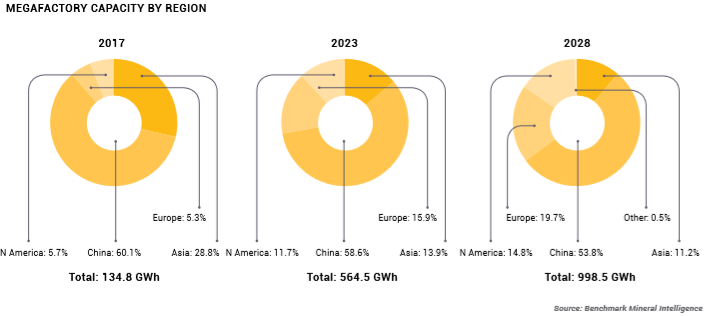

According to a report from Benchmark Minerals Intelligence however, the demand for batteries, and therefore graphite, is predicted to be much higher in Q3 and Q4 this year. Looking further ahead paints an even starker picture for the future of graphite according to that same BMI report.

Further, BMI currently anticipates an additional 860 GWh could come on stream through the development of new battery megafactories by 2028. This potentially could equate to 950,000 tonnes of additional quality flake production over this period.

The supply and demand mathematics of this scenario is quite simple.

At present, the annual production of natural graphite totals approximately 1.2 million tonnes. Of that 1.2 million tonnes, only around 15-20% is currently used in batteries.

In order to meet a demand of up to 950,000 tonnes per annum for battery grade material, an additional 2.5-3 million tonnes of graphite will need to be produced each year. While the path for the growth in demand for EVs seems reasonably clear, the necessary growth in the production of graphite to meet EV demand is not.

The question is, what is going to happen when demand significantly outstrips the current supply? Well, with the beginnings of a price pinch already being felt, it appears the answer is rather clear.

Note that any decision with regards to adding this stock to your portfolio should be taken with caution and professional financial advice sought.

Tom Revy is the Managing Director of BlackEarth Minerals NL (ASX: BEM).

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.