Funding allows Northern Minerals to make a start at Browns Range

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Heavy rare earths developer, Northern Minerals (ASX:NTU) announced on Thursday that it had received the first $9 million tranche as part of a $30 million equity investment by Huatai Mining, part of Chinese coal trader Shandong Taizong Energy.

To provide some background, NTU initially flagged the Huatai Mining transaction in September, and in October the company received Federal Investment Review Board approval for a $30 million equity investment. During this period NTU’s shares increased from 10.5 cents to hit a high of 17.5 cents in late October.

The recent retracement to yesterday’s closing price of 14.5 cents appears to be a response to broader market weakness, as well as some profit-taking.

Consequently, the current trading range could provide a useful entry point. However historical trading patterns are not necessarily an indication of future share price performance and this should not be used as the basis for an investment decision.

NTU is an early stage mining company which should be viewed as a speculative investment, and as such independent financial advice should be sought if considering this stock.

Development of pilot plant at Browns Range

Receipt of the first tranche of $9 million allows NTU to commence pre-commitment works for the development of a pilot plant at its Browns Range project, which is a large landholding spanning the Western Australian and Northern Territory border.

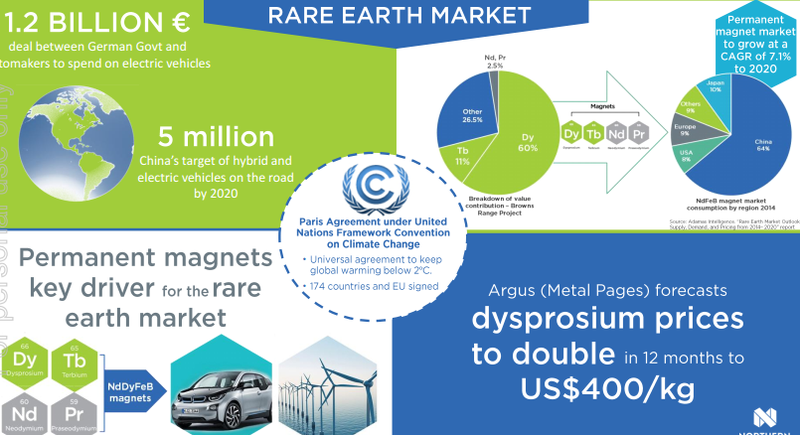

Management views the area as highly prospective for heavy rare earth element dysprosium, an essential ingredient in the production of dysprosium neodymium iron-boron magnets used in clean energy and high technology solutions.

Electric vehicles drive increased demand for dysprosium

Management highlighted that there is increasing global demand for these applications, and the project’s xenotime mineralisation has facilitated the development of a two-stage process flow sheet consisting of a beneficiation and hydrometallurgical plant to produce a high value, high purity dysprosium rich product.

With NTU now in a position to organise longer lead time construction equipment and facilities, Managing Director, George Bauk highlighted the significance of this development in saying, “With an expectation of a final investment decision in early 2017, our project development team is moving ahead with an initial site works to ensure we fulfil our strategy of achieving first production in late 2017”.

Potential investors should note that forward-looking statements regarding exploration and production outcomes are estimates that may or may not be met. If considering this stock, independent financial advice should be sought.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.